It’s springtime, a short tariff holiday, and people are thinking about moving jobs, schools, and homes.

Take Ashley and Michael Burke, a mid-30s, dual-income couple in Houston who’ve tired of renting, and have saved a chunk of money. The Burkes found a home, their first home, with an asking price of $1.2 million. Buying a home seems more responsible. Their uncertainty is whether they can afford the monthly payments. This is where expectation and reality diverge.

Mortgage rates today are higher than four years ago, and the payment size matters to the purchase decision: loan payments are ongoing commitments until a purchased home is resold. But that is only part of the commitment.

If the Burkes circle the Internet, they will find plenty of mortgage payment calculators with whistles, ads, and related debris, but fewer bells to help them measure the impact of a mortgage on a family budget.

What do the Burkes need to know?

The total cost of borrowing and home ownership gives a better perspective.

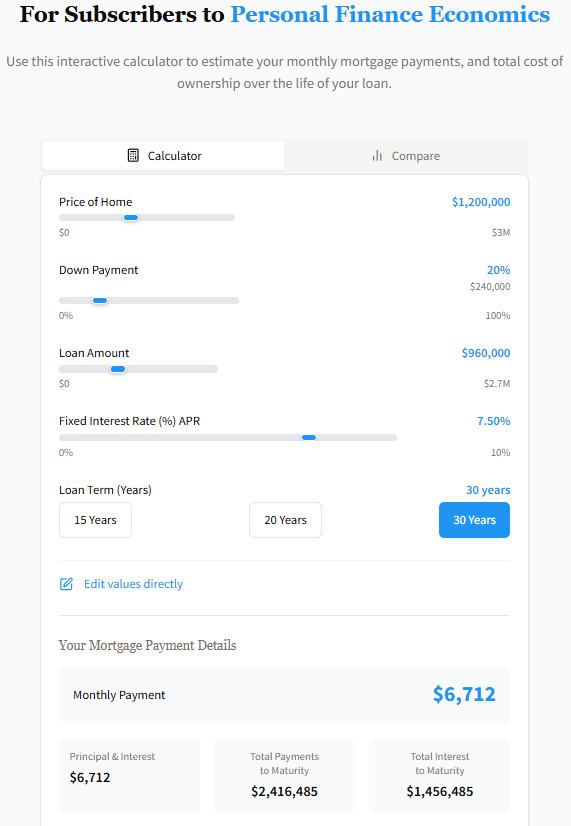

I am launching a cost of ownership tool for subscribers that emphasizes this point, wrapped in a clean interface.

Using the Personal Finance Economics Cost of Ownership Tool

The Burkes’ monthly mortgage payment depends on a) the difference between the price of the home and their down payment, b) the annual percentage rate of the loan, and c) the length of the loan time period, normally 30 years. Their details:

Negotiated price of the home = $1.20 million.

The Burkes have $240k for a down payment.

The mortgage rate APR for a 30-year fixed interest rate loan is 7.5%.

The calculator's mid-range section is titled “Total Cost of Ownership.” It adds property taxes, homeowners’ insurance, any HOA fees, and an estimate for home maintenance.

In Burke’s case, Harris County, Texas, has an average property tax rate of 1.71% of home valuation. I estimated $3,000 for homeowners insurance, $100 monthly for their HOA, and a 1% of home value annual home maintenance budget. In practice, a real estate agent, mortgage broker, or title company can share approximate rates and costs.

The Burkes’ monthly payment to honor their loan is $6,712, a breath of fresh air relative to its cost of ownership cousin. Cost of ownership differences vary by household, the location of the property, the insurance market, and other factors. For the Burke household, $9,772 is a more realistic measure of monthly cost if they purchase their ideal home.

Affordability

The last point is an important one. Can the Burkes afford $10.7k per month in addition to other living costs? I prefer more precision than some rule of thumb that might suggest the total cost of ownership is no greater than 33% of pre-tax household income.

A baseline, economics-driven financial plan is infinitely more informative, and I offer coaching to help you build one.

From the Archives

Releasing Cash in a Hot Real Estate Market

Ann and Sam Williams are unabashedly proud of being Texans, “5th generation,” they would tell you if you looked like you were a Yankee or drove a Subaru with a Big Sur sticker on the bumper. The W…

Are You Moving?

Note: The past two weeks have focused on your home base, whether downsizing or giving subscribers the four steps to evaluate where to live. Details are in this week’s book installment, which discus…

Robert...really appreciate this scenario, analysis (and calculator), particularly appreciate your economics-driven framework. In thinking through this scenario, would the affordability analysis need to consider any likely additional cash requirements, beyond the down payment, that relate to start-up costs of owning a home (e.g. furnishing home) which may put additional pressure on their cash position/savings in year 1. Also, would it help the economic analysis scenario if calculator could include an assumption related to their holding period (e.g. sell home in 3 or 5 or 7 years), any implicit home price growth rate (0%, 3, or 5%), and calculate any potential gain on sale (and any potential return on their cash/equity position available upon sale). Any potential return (or no return) could be important element to consider in the affordability (and they could use that to evaluate the opportunity cost of their cash used to buy or continue to rent/save/invest). These elements may or may not be applicable in this scenario or framework, just surfaced when I read through the scenario and analysis. Thanks so much for all you share here, it is really important (and thought provoking) content.

Good work!