Note: The past two weeks have focused on your home base, whether downsizing or giving subscribers the four steps to evaluate where to live. Details are in this week’s book installment, which discusses the economic effects of a geographic choice. This updated post, open to all subscribers, offers an additional perspective. Enjoy.

The holiday stretch brings Mary Beth and Scott Glenn to NorCal for some golf, biking, hiking, and an escape from the slow thaw of icy Madison winters. Scottie and Mary Beth bought and paid for a tiny California ranch in Carmel as their permanent vacation spot three years ago. Why Carmel? Because it is Carmel. In Carmel, there is a magazine entitled 65 Degrees. It is a spectacularly beautiful respite where a secular person would call it the altar if you love golf as much as Mary Beth. A Catholic would be at the spiritual home of Junipero Serra and the Carmel Mission, not far off Highway 1. The Glenns have all their boxes checked, getting as much time in Carmel as possible when not at work delivering education to the masses at UW.

Getaway time means Scottie works out at Carmel Valley Athletic Club, which is not far off Carmel Valley Road. Finally, in a post-pandemic world, Scottie can get back into group ex, and he just captured an RPM class populated by what he calls the “Cali girls” and a couple of older gents who were in class because it is mainly populated by Cali Girls. Mounted on top of his bike listening to EDM, jumping up and down in unison, he realized how much he missed the group classes. Sweaty, motivational, a jumper cable applied to his heart, he decided that when they returned to Madison, it would be, aw must be, no more staring at a flat-screen Peloton for a while. Cody Rigsby doesn’t move the ticker as high. Scottie is convinced he needs to return to a Dane County Y, then a not-very-Californian trip for some fried cheese curds on the way home—a born and bred badger. Burn 700 calories. Feel great. Then consumes 1,000 calories of fried cheese. The rest of the day awaits.

Scottie and Mary Beth are that age. Their children are launched, there are no grandchildren yet, they are in excellent health, and they have a shared interest in a new adventure. Lives connected, the Personal Finance Economics story for Scottie and Mary Beth, where next?

What is your “next?” The same principles apply to you if job and opportunity make moving a consideration.

The Glenn’s Story

Ready to consider giving up Madison, the Glenns plan to keep Carmel while their three children are scattered about the country. In their late 50s, they can land a job teaching in Arizona, Florida, or Texas, where Wisconsin winters can be permanently avoided while keeping the Carmel spot where the daily temperature has low variance. Location and the cost of living are the next steps. In terms of numbers, how does Madison stack up to alternative cities? Candidate cities bring a different environment, political climate, and opportunities for new friends at the cost of disrupting the norm.

We will stay focused on what we do best: focus on the economics. In this case, consider relative living costs as an important, but not lone, input to obtaining their highest living standard. Against those results, all the other qualitative costs and benefits of candidate cities can be compared so that Mary Beth and Scott make the best decision for them.

The Cost-of-Living

Emotion, family considerations, and the alignment of preferences complicate geographic choices for couples. These concerns may be quickly allayed from the quantitative story, particularly in tail-of-the-distribution comparisons where living costs are extraordinarily different.

Newton, IA resident to her boyfriend who shares her desire for a metro life: “you mean my $112,000 home will cost me $780,000 in Brooklyn. We could never afford to live there. I am not moving there.” Decision made.

For most couples, though, financial effects can nudge behavior. While the numbers are estimates with variance, numerical clarity across two sets of eyes is more likely than qualitative-only concerns. At least, that is my bias and an approach I advocate. Here is how to approach the question surrounding “The Next Move.”

The Glenns want to consider three locations: Scottsdale, AZ, The Woodlands, TX, and Tampa, FL. A good free source for living factor differences is Best Places, and a quick glance at cost differentials for a broad definition of expense categories is listed below,

The median cost of buying a home in Scottsdale is substantially higher than in Madison but lower in Tampa, and data excludes property taxes. From these living factor data, it is hard to roll up the changes and summarize cost-of-living differences for a few reasons.

Cost differentials are important only if expenses continue to be incurred after a move. If moving from Madison to an all-inclusive golf course community in Scottsdale permits Scottie and Mary Beth to have one less car, then that fact needs to be represented—less fuel, auto maintenance, etc. Consequently, the Glenns must have their expenses disaggregated slightly before applying living factor changes.

Taxes need to be considered because of the obvious effects on take-home pay and the cost of homeownership.

A move may prompt a change in home financing if the Glenns are sitting on a low APR mortgage loan. A comparable home in Scottsdale and The Woodlands will cost more, so the quantity of new financing and the higher mortgage rates observed in the market today will alter discretionary spending.1

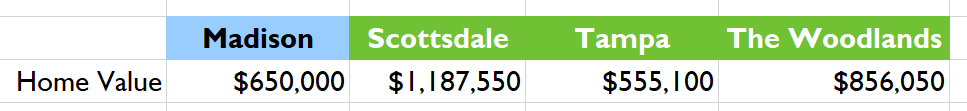

Median Home Values

One starting point is home value. Markets in different geographic areas have different baselines and differing volatilities. The Glenn’s home in Madison is valued at $650,000 today, and they have $360,000 of equity. Median-priced homes in Scottsdale and The Woodlands are higher,

Suppose the Glenns apply the equity from the sale of the Madison home to a relocation purchase in Arizona or Texas at the comparable median price level. In that case, they will have to carry more debt. At a 7.06% rate on 30-year money today, the 3% money on their Madison home loan is a money saver. But it suppresses the adventure if a comparable home value is necessary.

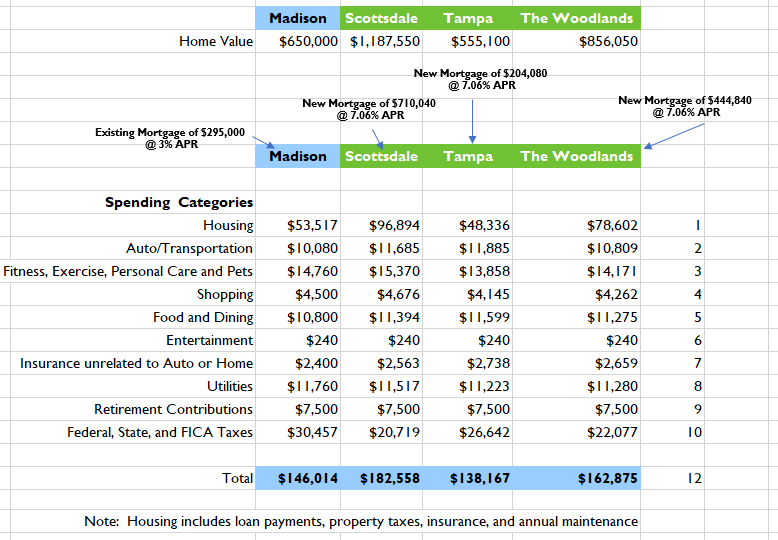

Tampa gets the cost nod based on a more granular view of Madison's household budget and a comparable budget in the three alternative cities. The table below summarizes Glenn’s cost alternatives.

Projected Annual Spending Totals, 2026, Including Taxes

Housing costs represent annual mortgage payments, property taxes, homeowner's insurance, and maintenance. Differences in housing costs exist due to the size and cost of mortgage debt and property tax rates. For example, in Madison, the property tax rate is $1.50 per $100 of valuation, Scottsdale is $0.90 per $100, Tampa $1.97 per $100, and $2.1 per $100 of valuation for The Woodlands.3

This annual budget snapshot is for 2026 only and both of the Glenn’s will keep working at the same household rate of pay, $150,000. Consumption and tax liability are income-dependent. Employee-based retirement contributions remained unchanged, but the tax story, line 10, is different. FICA taxes are set at a fixed rate, so that doesn’t change by geography; however, Tampa and The Woodlands have no state income tax. Scottsdale and The Woodlands have associated mortgages for the Glenns that change the deduction levels to calculate the federal income tax liability. Tax differences may not be as stark as one would assume. Sales taxes are left out, which matters for consumption, but the lowest average income tax state, Arizona, is about $10,000 lower than Madison.

Housing costs and taxation are the primary drivers of these city choices. Tampa is favorable not so much for the $4,000 annual tax savings over Madison as for the comparable lower median home cost, which implies less of a mortgage loan and lower aggregate property taxes. The insight that housing cost is critical is unsurprising, regardless of geographic location.

If either Scottsdale or The Woodlands offer must-have lifestyle benefits to the Glenn’s, then downsizing their home would be the financial ticket.

The Glenn’s Current Lifestyle on $150k?

One last comment: How do the Glenns afford their current lifestyle on a $150,000 income? They already own Carmel and can use savings to help pay the bills because they have ample Social Security retirement benefits and projected retirement plan withdrawals. This is all part of a long-range economics-based financial plan. You can obtain the complete financial plans by commenting on this post or messaging me here on Substack.

When the Glenns move, they would have their Madison home equity to put down toward a new home purchase but will give up a 3% APR mortgage loan. I assume any new mortgage loan is at the current 30-year rate of 7.06%.

How do we align our finances with our dreams when considering a new place to call home?

If they were to move, would Tampa be the best choice because of the lowest cost?