Releasing Cash in a Hot Real Estate Market

How to evaluate if downsizing makes sense

Ann and Sam Williams are unabashedly proud of being Texans, “5th generation,” they would tell you if you looked like you were a Yankee or drove a Subaru with a Big Sur sticker on the bumper. The Williamses had lived just off Westlake Drive for thirty years, long before Austin had been discovered by Californians who needed to get out of the most beautiful state in the union. Ann and Sam met at UT in the mid-1980s, walking around the “Forty Acres” and going back and forth to class. That was a time when students made eye contact because Steve Jobs hadn’t invented the iPhone yet; the putty-colored desktop Mac was on his mind.

Looks led to curiosity and coincidental attendance at a party, during which Sam approached Ann and said, “My Momma told me there would be more pretty girls in Austin than doves in our cotton field, and she was right. Are you free next Friday night to go with me to listen to some music?” Ann’s agreement led to a year and a half of dating and marriage. Travis County became their forever home.

The Family Home

Four children became the sixth generation of Williamses, and a three-bedroom home helped to raise them. The youngest child, Elizabeth, is two years into college at the University of Alabama. “Roll Tide?" A youthful mistake, Sam thought privately, that had nothing to do with the Williams's interest in changing their definition of their forever home from their West Lake Hills spot to, well, just anywhere in Texas. Some would describe Austin as the “Hill Country,” with a sloping terrain dotted by homes once outside the 183/360 loop. West Lake Hills is inside the loop, adjacent to Lake Austin, and seven miles from the University of Texas. Four kids launched, neighborhood turnover, and significant price changes in West Lake in the last ten years gave the Williamses a sizeable real estate asset and financial flexibility. It is valuable residential real estate, $2.9 million, that, if sold, would put more than a guitar and tractor in their life.

Wealth Creation - Residential Real Estate

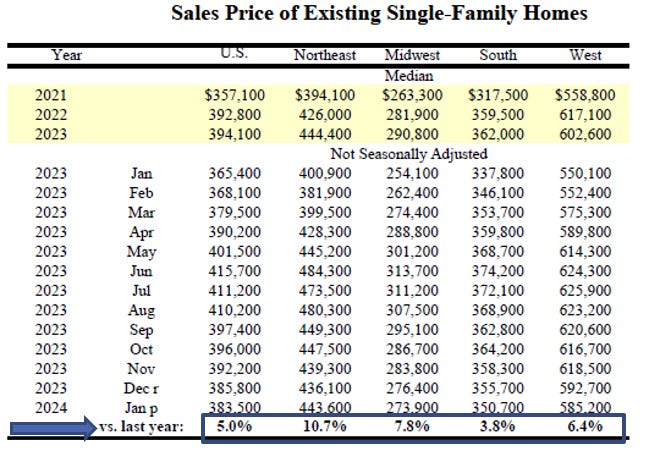

Over the past few years, the home market has been white hot across the U.S.1 The table below reveals what many legacy homeowners and prospective new homebuyers know: median prices have increased substantially over the last three years. The last row displays recent year-over-year growth for the U.S., broken down by region. That is the downsizing opportunity: older homeowners, mid-lifers, and retirees can release cash after paying some capital gains tax that may increase their living standards.

How much cash? That is more complicated because a mortgage and home equity loan may have to be paid off, there may be up to a $500,000 exemption on the gain depending on home usage and IRS filing status, and capital gains tax rates vary. But take-home cash is just one component of any downsizing decision: we have to live somewhere.

The living standard effect answers the downsizing question because it considers the net cost from the sale, the costs of the new home, the change in Medicare Part B premiums (linked to taxable income), and prospective returns on the new, investable cash.

Downsizing to the Lake Travis Area

How about Ann and Sam? Many couples of that age between empty nester-dom and formal retirement trade-off a home now too large to one smaller, likely newer, with lower utility costs and more amenities.2 The Williamses have always liked far west Austin near Spicewood, mostly open ranch land near the Lake Travis reservoir and home to Ben Crenshaw’s private Austin Golf Club just off Hwy 71. Downsizing means a country life, quiet, the smell of skunks, a shotgun blast or three, and the howls of coyotes—a marked change in lifestyle from the short drive downtown to 6th Street. Living in Spicewood requires 35 more miles, which is rarely a quick drive. A night in the town requires bringing roller bags.

Downsizing may involve necessary but non-quantifiable trade-offs. Feelings that life is changing, memories no longer triggered by household reminders, sounds, smells, venue proximity, and pace. Benefits or costs are in the eye of the beholder and need to be weighed. In this space, though, we focus on what we can measure from the economics of the decision, and Williams’ set of factors include those in the following table,

Quantifying the Choice

Ann and Sam’s West Lake Hills home has a significant capital gain, the difference between a $2.9 million market value and their original purchase price. Property taxes, homeowners insurance, maintenance, utilities, and fees are annual spends. The sale of West Lake Hills comes with a 5% cost at closing. The buy-side property near the Lake Travis area is about a third of the value, with lower annual property taxes, higher homeowners insurance costs, and lower utilities and fees. New homes come with warranties that lower maintenance costs. Transactional closing costs are one-time and much lower for the buyer than the seller. The Williamses paid off their West Lake Hills mortgage long ago and are paying cash for their new home.

What is the change in their living standard? It increases by 52.4% over the balance of their lifetimes above their current financial condition, staying in their West Lake Hills home.3 The increase is dramatic. What is the driver?

In both plans, the home is left to heirs at the second to die. Selling the more expensive home releases cash for the Williamses while living.

For example, optimizing the living standard in the current home provides Williamses with $168k of spending power next year. If they sell and buy the smaller house, the living standard will increase to $220k next year. In either case, they have their magic number, which happens to be 31% higher if they downsize. More fun, higher charitable contributions, and specialized savings toward a continuum of care facility are potential avenues with their new living standard. The choice is theirs, created by their homeownership. Good fortune? Maybe. What will they do now? Their choice, too.

What would you do if you were in the Williams’ shoes? Comments are open.

Note: If you want to construct your own financial plan, see Chapter 3 of the book, which guides you through the basics of the economics-based financial planning software. You can DIY a financial plan, and a benefit of a paid subscription is that you have me as your resource. Direct message me if you have questions.

Source: National Association of Realtors, Existing Home Sales Data.

Ashley Thomas is in operations at the JoAnne Johnson Real Estate Group and graciously shared “Simplifying Your Home or Rightsizing,” which addresses some aspects of this question and the value of de-cluttering. The latter point caught my attention because academic research exists on the messy v. tidy household and how that affects interest in downsizing. Ross, Meloy, and Bolton explored this in a Journal of Consumer Research article. It will be unsurprising for readers to learn that we don’t model tidiness in PFE.