We are having a stock market moment. Push up, drop down, long pause. Inevitably, the question is: Is it going off a cliff?

You may feel a little less comfortable today about your financial future.

A higher level of anxiety in the public domain will drift into how households spend, businesses plan, and monetary policymakers shape their decisions.

Most of us want our retirement plans to grow or our children’s education funds to stay on track. While you cannot control the performance of your investments, you can control selecting funds that better match to your risk tolerance.

Two steps to hit your asset allocation target.

Step 1 was last week. I shared how to measure one’s risk appetite and link taste with a suitable investment mix, measured by the percentage of stock investments relative to all financial assets.

Step 2 is today. How to find pre-built investment mixes. I’ve included an excerpt from chapter 6 of our book.

Comments and your questions are open at the end.

Rely on the Reported % in Stocks or Equities

Imagine a novice investor who walks into a brick-and-mortar investment company store, meets with one of the newly minted financial advisors to ask a few questions, and an hour later has a risk profile in hand and an information tornado in the head. Scooching around the seat of an office chair with cash safely in their pocket, the investor's self-doubt creeps in with the thought, ``What do I do next?'' Then comes phrases like, ``We advise your portfolio should be ``moderately aggressive,'' or ``growth-oriented, or ``a growth and income strategy' would be your best bet.”

This swirl of finance-speak coming from advisor to investor isn't helpful. How financially literate do you need to be? The novice saver would have a headache. The experienced saver, not so much. I will help you cut through it.

It is common for an investment advisor’s portfolio recommendations to take a generic form after assessing risk tolerance and savings duration. The seemingly ambiguous portfolio phrases relate to the likely mix of investments and pre-determined portfolio candidates that honor the saver's risk profile findings.

This active asset allocation process formalizes and measures how assemblies of different portfolios yield different levels of risk and expected returns. The intent of the process is for investors, advised or self-directed, to make more risk-accurate choices for themselves. Ultimately, the practice involves multiple asset classes, such as stocks, bonds, cash, Treasury Inflation-Protected Securities, etc., to achieve the best strategy for the investor.

The Good News

The outcome of active asset allocation is to take an investor’s measured taste for risk and match it with a recommended investment mix. All investment companies follow a scale from low-risk to high-risk, and a range of portfolios from slightly higher than low-risk to slightly lower than high-risk fills the broad middle range.

Three examples.

Vanguard defines risk as “risk potential.” If you are okay with a higher level of investment risk and you want an out-of-the-box asset allocation fund, Vanguard points you to their “LifeStrategy Growth Fund.” 80% stocks, and Vanguard chooses how the 80% is met.

Fidelity’s recommended product offerings associate a vertical slider for risk from lower to higher. The “Fidelity Asset Manager 85%” fund would be the ticket for a higher level of investment risk—85% in stocks. We’d have to click through their hyperlink to learn how they compose this mix.

Schwab uses terms like “Balanced” and “Conservative,” where the higher the risk, the higher the proportion of stock investments. Their “Equity” asset allocation is 100% in stocks, while their conservative offering is 40% in stocks.

The good news is that these funds are pre-assembled and one click away. More good news is that asset allocation products are not limited to brand-name investment companies.

Investors should seek an asset allocation fund by its lowest cost to achieve it.

Funds report their “expense ratio,” and nearer zero is preferred. Why pay an investment company 1% for an asset allocation fund when you can go to another investment company 0.05% for the same mix? Higher expenses take away from the investor’s return.

Vanguard takes this head-on, reporting how its asset allocation fund VASGX’s expense ratio compares to similar funds offered by competitors as determined by fund data guru Morningstar.

The 0.64% difference benefits the investor’s actual return.

Your outcome after Step 2: Take cash. Buy the preferred low expense ratio fund. Assets allocated.

More Asset Allocation Offerings

Asset allocation products are not limited to brand-name investment companies. Many investment companies have menus of asset-allocated investment choices, and we can readily find other choices.

Try this.

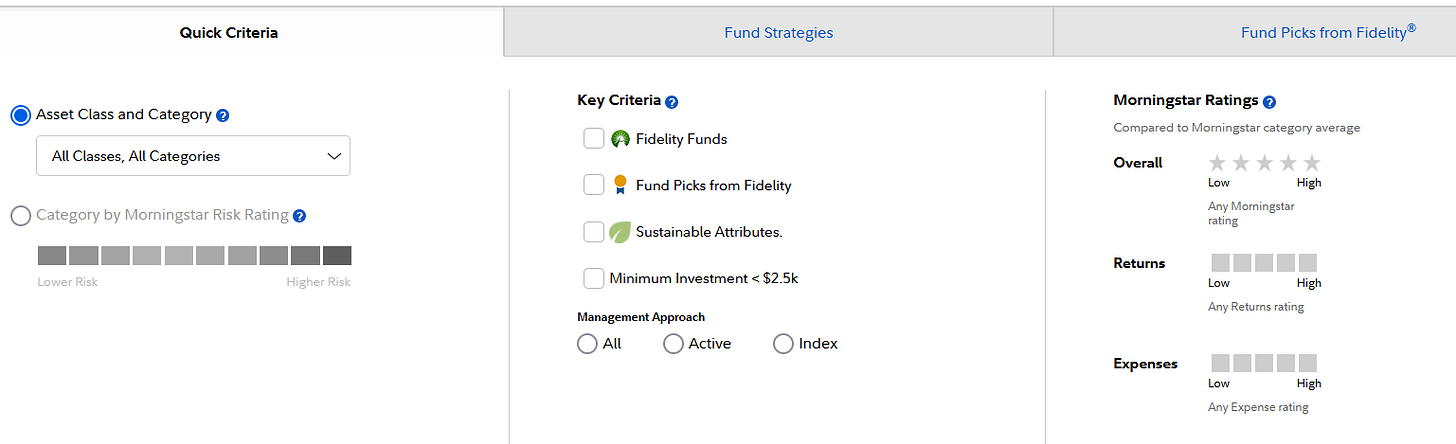

Fidelity has an open-source tool for finding asset allocation funds, many of which are not Fidelity funds. The link will pop up with this setup.

Under “Asset Class and Category” select “Allocation”

Within the Allocation section, select 5 sub-categories,

Select two of the Morningstar attributes. The first, is to find all Morningstar asset allocation funds that are four or five stars.1 The second, is to restrict the search to asset allocation funds that have below average expense ratios. As of this writing, this yields 90 fund choices.

Why a Morningstar “Stars rating?” It is a simple heads-up about the asset allocation funds that have performed well. But Stars isn’t predictive. As Morningstar states,

“The star rating shines a light on fees that can erode the ultimate returns on an investment. One trade-off: the rating only reflects historical returns, which don’t guarantee future performance.”

Last Words

If you save outside of a retirement plan, you should have a brokerage account with a major player.

It is the account everybody needs.

Separately, Morningstar can be the one key source for asset allocation funds and they offer a 7-day free trial. Educational institutions with economics departments or business schools may license Morningstar and give digital library access to graduates and current students.

There is mixed evidence that a Morningstar 4 or 5 star fund this year will predict funds that outperform their category competitors. It is public information, after all, and based on historical performance. Armstrong et al., however, find evidence that Morningstar’s “analyst rating,” or what is now called the “Medalist Rating,” which forecasts performance, is associated with higher returns.

Good point about keeping your investment costs down. Warren Buffett also recommends investing in low-cost index funds for most investors.