For several years, I have required students in my life-cycle economics class to place a capstone on their semester by building an economics-based financial plan for an actual household. Ivory Tower hypotheticals and speculative case studies are not as sticky. Real people, real plans, real impact, and a higher level of understanding for students who engage their learning with their “client.” Sophisticated software helps it along.

Client households tend to be young, often single, and out in the world working full-time. Some heard about financial planning before sharing private financial information and risk preferences; those who signed up became engaged because they did just that. Regardless of the age at which we begin thinking about financial planning, we have a starting point plan. Indeed, some subscribers are older and have financial advisors but likely have not had an economics-based financial plan.

It occurred to me that in this space, over the past two years, the writing has been more related to specific financial planning questions, e.g., “If I use a Roth IRA to fund my child’s college education, is that better than a 529 plan?” There are a thousand important financial planning questions where conventional wisdom falls short. How do you choose a new location to live, whether to put Mom & Dad in a step-down community and whether more education is worth it? The types of questions where details and economics inform the better choice. What may not be obvious is there is always an implied baseline resting in the background when evaluating specific questions. Financial managers of firms have existing earnings as their starting point to assess a new growth strategy. Expectations and risk of the growth strategy are measured to know if the strategy is additive to existing earnings.

By contrast, my students’ clients want a financial starting point and guidance about spending and saving. They want a path to obtain their highest living standard that doesn’t change until a consequential change affects their economic life—a raise, a job dislocation, a new baby, etc. We all need to know where we are when we stand on the blocks, ready to jump in.

In our world, the starting point is the financial plan that identifies a household’s optimal living standard today and the risks to its value. The plan is prescriptive because it identifies this year’s best spending/saving strategies, but with the perspective of the future, expected earnings, inflation, and investment returns. All the important details needed are a subset of what conventional financial planners want their clients to provide.

The Information for Your Baseline

I have always wondered how many people contemplating hiring a financial planner regress to do nothing when they learn the information they are expected to provide upfront. Expense habits, defining short-term and long-term goals, measuring risk tolerance, and those come before trying to align the preferences of the adults in the household. Is it not difficult to get a household agreement on something simple like, “What’s for dinner?” Frightening when thinking about a financial overhaul? Conventional financial planning comes with a high barrier to entry that usually requires a crisis to confront. Interested readers can find an Investopedia that summarizes the standard approach here. Conventional financial planning comes with a high barrier to entry that usually requires a crisis to confront.

The fuel for the engine of an economics-based baseline financial plan requires data but is generally handier. We live in a known tax regime with a call on Social Security benefits related to our earning history and prospects. Taxes and government benefits are woven into available economics-based financial planning software. Coders have made outputting our economic footprint easy, based on our answers to a shorter list of specific questions.

There are a few essential pieces of information, and assembling a mind-numbing listing of expenses is not one of them.

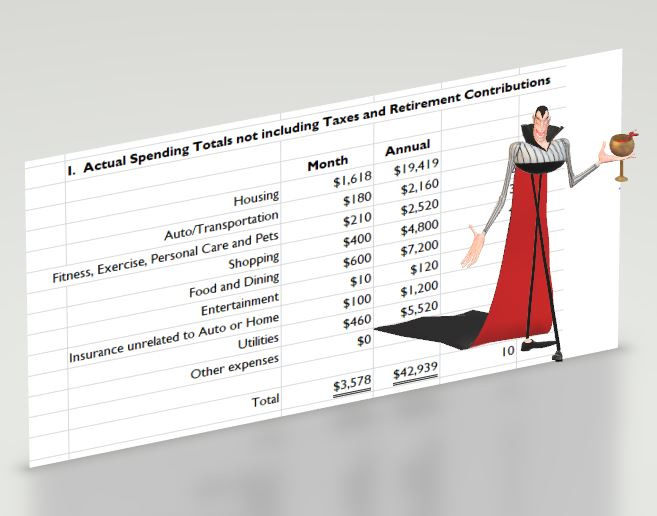

Most important is job-related employment and a listing of assets: financial accounts for checking, savings, investments, and retirement plans. Below are the details, divided into three sections. Eighteen items establish the baseline, get the conversation a long way down the road, and produce this year’s optimal plan.

Household Demographics

The birth dates of every member of your household.

Expected retirement age and expected longevity or max-age of life.

Spouse, if any, expected retirement age and expected max-age.

Current annual income.

Do you think your earnings growth will generally match the rate of inflation? Or, grow twice as much or half as much?

Spouse’s current annual income.

Prospective earnings growth for spouse’s income relative to the inflation rate.

The current amount in bank checking and bank savings accounts.

The current rate of return on regular assets such as checking and bank savings accounts.

Do you have a brokerage account where you have investments such as stocks or mutual funds? If so, what is the total current value? What is that amount if you systematically contribute to these investments (typically monthly)?

Do you currently set aside any monthly amount for an emergency fund? If so, how much did you set aside? If the account is a bank checking or savings account, a brokerage account mutual fund, or exchange-traded fund, report the current value and whether the current value is included in items 8 or 9 above.

Go to Social Security.gov and set up an account if you haven’t already done so. It is an excellent way to see your past earnings history, which is the basis for future Social Security benefits.

Current Retirement Plans, if applicable

Do you have a regular IRA? If so, how much is the current value? Do you make regular contributions?

Do you have a Roth IRA? If so, how much is the current value? Do you make regular contributions?

Do you participate in a 401(k) or 403(b) plan? If so, what is the current value? Do you make regular contributions? Does your employer contribute? If so, what are the amounts monthly? % of salary contributions are a standard way this information is reported by employers who establish these plans

Do you work for a firm that offers a defined benefit pension plan? If so, please provide your planner with the details.

Dependents

If you have children, ensure you have included the DOBs of the children.

Is college on the horizon? 2-year? 4-year? Private? If you have a 529 savings plan for education costs, report the current value of the account plus monthly contributions to the account.

The Result

It doesn’t take too much effort to derive the baseline.1 What will this plan do for you? It will determine your highest attainable living standard for this year, and you will have the fun task of choosing how to achieve it. That means spending how you see fit up to a single spending amount. Should you go at it on your own? You can, but there is a role for a financial planner who understands the economic methodology. Choices involve trade-offs, and expertise facilitates good decision-making. A trusted advisor to help make the best decision. I would want that from my personal trainer, attorney, physician, and accountant. Financial planners should be treated similarly.

In class, my students use the Pro version of this software.

Building on the fundamentals I learned in class, I was able to piece everything together for this financial plan assignment given to me. The process of applying these concepts and seeing how they all fit together has been both educational and enjoyable.

As I am now working on this project I agree it is very beneficial and this taught me a lot!