Rid Yourself of Bu$%&*

Budget, Spendfulness and Finfluencers

Social media houses innumerable, anonymous personal finance and investment advice spaces.

In the world of personal economics, “Budget” is a word that never made sense to me. Undergraduate students would enroll in my class, mentioning their parents wanted them to learn about budgeting, but my class wasn’t about budgeting.

To budget, isn’t happy.

“You need a budget,” always gets a negative response.

“Budgeting is necessary for financial happiness” isn’t true.

Budget apps don’t sell well because they are misnamed. Budget is today’s B-word.

Fortunately, YNAB, one of the more prominent budgeting apps, has dropped the B placeholder in its name. Their pitch is “Spendfulness.”

I like the pitch because it tickles the edge of economics-based thinking. When you categorize spending transactions by whether they are discretionary or non-discretionary expenses, you begin to understand the quantity of fun spending. How we spend for fun is incredibly informative about what our household values. YNAB and other budget apps make it easier to understand the quantity of spending because their primary value is scraping our financial accounts periodically and summarizing the results. For a small price, we forego the requirement to manually tabulate our expenses to understand them.

But that is about it.

The open end, in fact, the problem with YNAB, other budget apps, and most CFP and finfluencer advice, is that answers to key financial questions are not grounded by available decision methods and tools.

For instance,

“Should we move and take the new job?”

“Should we use a 529 education plan for our child’s education?”

“How much should we save for our retirement?”

“We are retired. How much should we withdraw to live?”

“I live paycheck to paycheck. Am I spending too much?”

There are a hundred questions like these. There are financial advisors who are well-versed in helping their clients answer these questions; just not enough of them. How do you find one who does? Ask them if they practice economics-based financial planning. Or, they know the work of Morningstar’s Thomas Idorzek, who is writing about “Lifetime Financial Advice.” Are they familiar with Nobel laureates Irving Fisher, Franco Modigliani, and Milton Friedman? They are the foundation of our book.

In the meantime, I hope that the YNABs of the world enhance their technology to generate answers to common questions because they can capture the needs of many moderate-income customers who have their questions.

Once a user of a budget app downloads their transactions they have most of what they need to turn a “here is what you have done” financial analysis, to “here is what you should do” answer to a financial question. That latter tool doesn’t exist.

If it did, users could fully understand the “What brings me joy?” question while moving down a better financial path.

Compost the B-Word

By contrast, what doesn’t bring me joy is the ginormous social footprint gathered by financial influencers who know how to influence households with bad ideas. Below is a good illustration of someone who is begging for help from a finfluencer. Look at the social media presence of this charmer, asked by a follower for advice: 44,000 views and 258 likes. Their question is important to them; you can feel the pain. Below the yellow highlight is the finfluencer’s response.

Save your financial life by moving to Planet Fitness and Mint Mobile.

258 likes. Wow. Isn’t there more? At least most CFPs know that these spreadsheet data represent a small portion of the information, which is part of the first step in the conventional financial planning process.

Remember my post about this ad campaign? This budding CFP may be the anonymous finfluencer.

What are the Problems?

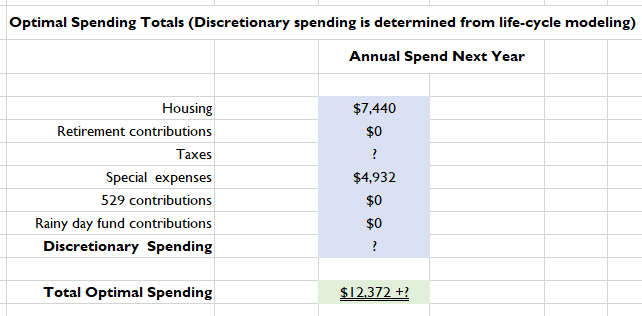

The follower conflates past spending (total debt) with current spending. After removing the total debt column, I’d roll up the three debt items (in yellow below) into a single payment obligation at a lower APR. I will call this single payment a “Special expense.”

A few more obvious issues.

There is no future on display beyond the next year.

There is no recognition of income taxes, tax credits, or Social Security taxes. Those are expense items that don’t help the picture but help inform future spending.

There is no recognition of the value of a checking account, savings account, or other financial assets.

There is a car. What is its market value? If it has more than $3,691 of debt, then that provides some financial room.

Anybody can feel the momentary financial pressure of a $24,000 annual income and $25,425 expenses. However, the follower’s financial opportunities need to be included.

Here is how I understand the follower.

At present, housing and paying off debt (special expenses) are the primary fixed commitments. There are taxes, too, but no information about them. The absolute key number to know is the level of discretionary spending. Yes, gas, groceries and scripts are not necessarily discretionary, but for our purposes will represent choices in type and amount.

The discretionary spending number represents the cap for the next year for all other spending. How the follower spends is the follower’s choice. In sum, it just has to fit.

The discretionary number for the follower is easily calculable (there is nimble software to do the complex mathematics), which uses the follower’s current financial assets and income, future financial prospects, taxes, and public retirement benefits present under current law. We’d need to know the follower’s age and longevity, too.

If only I knew the follower. With a little additional financial information, good work could be done. This would be especially valuable for lower and moderate income households.

There’s no answer to my question except to go out and get a physical job which I hope my body can hold up for

What apps do you recommend to track and manage expenses that people actually adhere to? Or is a simple Google xls spreadsheet enough to do the job, great article.