How do you invest your savings? A bank savings account, a 401(k) with your employer, maybe an I-Bond from the U.S. Treasury? Most of us have a “portfolio,” even though we might not think of it as such. Households with a bank checking and savings account have financial assets. Along with their ability to work, it is their wealth portfolio.

Most households have to learn about investing at some point.1 For most of us, an employer who offers a 401(k) or 403(b) plan is our introduction. Thrown into the deep end, a valuable employee benefit places us into a world that beckons our decision about how to invest these monies.

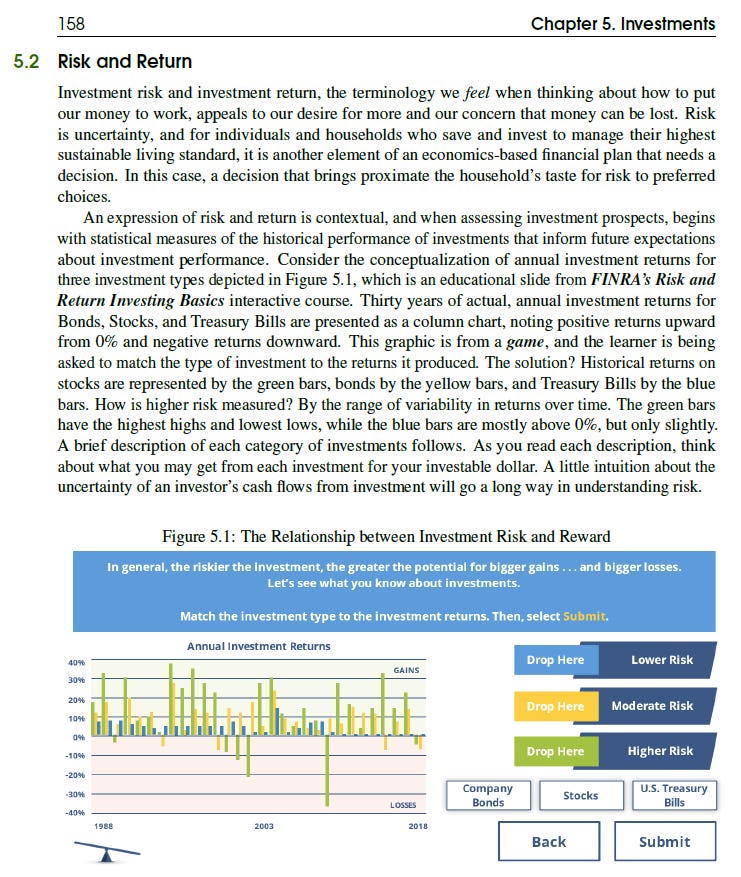

This installment begins the learning process about publicly available investments and presents historical results from nearly 100 years of exposure to the risk and return of broad categories of financial assets. If this is your introduction to how well-known financial assets have performed, you will find the results amazing! And, by the way, you will always need PFE to help make good economic-based planning decisions, even if you work with an advisor or read Burton Malkiel.

Today: Introducing the historical performance of stocks, bonds, and Treasury Bills as a first step to thinking about risk and an investing future. The PDF includes last week’s installment, too.