Are you amazed when you think about finances? Today, we rev-up the Personal Finance Economics engine.

One of the reasons an SMU student enrolls in my life-cycle economics class is that Dad or Mom suggested they need to know “how to budget.” Avoiding surprises and learning that budgeting is a process to help manage money is a motivator of such parental advice. By contrast, the budget can be thought of as a financial placeholder, the spreadsheet or pencil and paper listing of where the money has gone and is going. Addition and subtraction of the funds moving in and out of financial categories. This too is a reasonable way of thinking about “a budget.” Whether we hasten the advice of our accountant, financial planner, or parent to know the details of our budget, each of us is already invisibly tattooed with our own budget compiled from recent transactions and lying in the background of our lives. Add a personal balance sheet which lists what we own and owe and we define our financial selves to date. It exists whether we explicitly know it or not.1

Target Your Highest Living Standard to Determine Your Budget

In practice, living standard and budget are closely-related. We can understand our living standard as our spending if we are single, and know our living standard is different if we are married and have children because total family spending is shared by its members. In general, any household financial plan should aspire to create the highest, sustainable living standard for its members. Today’s financial plan is the least uncertain financial plan in a series of increasingly uncertain future financial plans that define a household’s future financial life.

Financial planning is complex because finances are complex. The real-world has details. Household’s spend money daily and less frequently receive income. We own our checking account, clothing, and maybe a car, home, and retirement plan. Our credit card statement will list what we owe our card company and many households will have an auto loan and mortgage. Every household is different, but we can trust one guiding principle that to set-up a budget for next year we need to find our highest sustainable lifetime living standard. Our highest living standard for the next year and subsequent years will be the shone light on our financial selves. We connect economic practice to economic theory with an algorithmic transmission that will drive decision-making. Reasoned solutions and no more rules of thumb!2

Knowing Your Current Living Standard

In the January 26, 2022 post I introduced you to the mythical couple Carlos and Gabriela Diaz, a young couple with two children, in a newsletter that focused on the importance of first knowing how we spend our money today. The Diaz household will be our case study. It will be helpful to have some numbers in front of us and we will use the Diazes as a “client” to illustrate their living standard. In turn, we will get our first glance at how to determine our living standard.

As a reminder, the Diazes went through the process of tracking down their major expenditures, which totaled $7,168 per month; about $86,000 this year. Most people do not think about a few other ways they spend their money which include federal and state income taxes, social security taxes, life insurance, retirement contributions they make or have withheld from their paycheck, and special expenses. Special expenses could be monthly spending dedicated to putting money on reserve for an emergency, educational savings (a tax favored 529 plan), or saving money for a large purchase. I have set-up Panel II to provide the annual grand total for the Diaz’s total actual budget, line 15, $141,131.

The Optimal Living Standard

Is there anything about how the Diaz’s spend their money that is good or bad? No other individual except for the members of this household can make that judgment. Non-discretionary household expenses support food, shelter, and clothing, and discretionary spending such as shopping, dining at a restaurant, and fitness are best valued by the household by preference, functionality, and fun.

The best effort to know the Diaz’s highest lifetime living standard requires knowing their household income today, future salary prospects, and the duration of those prospects. There is no doubt that a bet on future life events come with risk and how risk can be understood and managed will be the topic of a future post. Today will be a starting point where a deterministic optimal level of spending results.

The perspective of Personal Finance Economics can benefit the Diazes because spending and living standard are put in context of the Diaz’s prospective incomes, interest in working, longevity, and prospective return on investments. If the Diaz’s want to work only until their kiddos are through college, then they may have more years in retirement then remaining years of work. That will make sense to some couples but not all couples. A household cannot suddenly turn off the consumption spigot while alive and even more reasonably would not want to diminish consumption dramatically once in retirement relative to preretirement consumption. It would hurt too much. The loss in satisfaction from a steep drop off in consumption needs to be weighed against a slight drop off in consumption while working to afford the savings necessary to live later in life. There are trade-offs. If that makes sense then you are thinking like a personal finance economist!

While the table above highlights current spending, we need information about the household resources to support the family. Suppose Carlos and Gabriela are both 38-years old, have a preference to retire at age 67, and expect a long lifetime to a max age of 100. Carlos will earn $55,000 this year and Gabriela $105,000 this year, both with salary growth that matches long-run inflation expectations. Carlos and Gabriela’s employers contribute 3% each year to a 401(k) plan. Today’s value of Carlos’s 401(k) is $56,500 and Gabriela’s 401(k) is worth $74,000. Both 401(k) plans are invested in a stock market index fund that is expected to earn a 5% nominal return. The Diazes are including in their budget an amount to fund $30,000/year for 4 years for each child to help with college expenses. Bank checking and savings accounts total $45,000 and a 0% real return.

The Diazes Optimal, Sustainable Living Standard

Sustainability requires contemplation of two other pieces of information. Long lifetimes come with the need to maintain a living standard for a long period of time, and any interest in endowing others with a gift at death diminishes the household’s living standard while alive. The Diazes expect 62 more years of living and less than half that number will be working. How about bequeathing funds at death? As mentioned, we assume both Carlos and Gabriela live until 100, and the only asset they wish to pass on is the value of their home which they intend to live in until death.

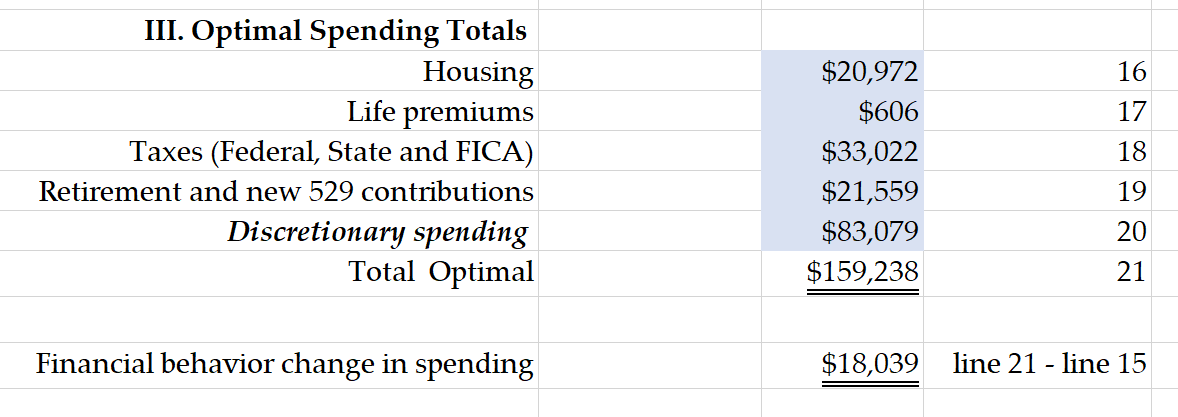

At first glance, the Diazes are saving in the 401(k)s and their joint pre-tax income of $160,000 appears to fit neatly above their actual amount. However, the level of spending and the highest living standard that best creates optimal economic happiness is a complex calculation. For this example, I used MaxiFi software that produced a trajectory for the future financial life for the Diazes given their current state of affairs. In the table below is a summary for this year’s optimal level of spending.

Lines 16 through 19 represent fixed commitments for the current year with housing explicitly recognized from line 1 in the table above. After considering all taxes, retirement contributions, and 529 contributions, the optimal amount of discretionary spending, $83,059, is reported in line 20 to cover all other spending for the forthcoming year.3 Line 21 totals up the optimal level of spending for the Diazes and sets the total of this year’s budget. The specifics of how the money is spent beyond housing, life insurance premiums, taxes, retirement, and 529 contributions is up to them.

There are two important takeaways from this case. First, the Diazes are undershooting their best and sustainable living standard. In other words, they can budget/spend a little more than $18,000 additionally this year to enhance their living standard. Second, while the methodology is generalizable, the result is not. This net change in recommended financial behavior isn’t good or bad, typical or not. If the Carlos and Gabriela were actually spending $170,000 in the current year because, for instance, they had very expensive cars with costly monthly leases, then the optimal living standard recommendation would call for a cut in actual spending to have a sustainable lifetime living standard at the appropriate level.

There is a lot to unpack and details underlying these results. This point remains: in Personal Finance Economics there is the best spending level and that result can be ascertained for every individual and household.

Subscribers, comment and let me know your thoughts.

A reminder: the January 26, 2022 post I gave you a path to run on so you can effectively catalogue your spending that will give you a benchmark to compare against you highest sustainable living standard.

The standard version of MaxiFi is cloud-based software for individuals who wish to do their own planning. It is a little more than a hundred bucks.

A fine point is that the level of discretionary spending reported by MaxiFi differs from the technical definition of discretionary spending, loosely described as spending that makes life fun. However, given only the costs of housing are explicitly considered, other elements of basic housing such as utilities, basic clothing, groceries etc., need to fit within the discretionary total reported on line 20. Spending for fun isn’t as high as we might think.

When examining how one can live at their highest lifetime living standard I think it is incredibly important to take time to examine what exactly the full financial details are within said persons life; both now and in the measurable future. I think many times individuals will sway to one extreme or the other (either only present or only future) but, for one to live their best financial life one will need to take both of those time frames into account. When this is done properly one can create a budget that not only allows them to spend at their at their optimal level in the present and put aside ample money to create a stable future. I think the Diaz family example is a perfect case of learning how to adjust from original situations and work diligently to acheive the proper balence between extremes and end up eventually finding the best financial life for one to operate in.

I agree that every household is different, yet when setting a budget, everyone needs to find their highest sustainable lifetime living standard. I find it interesting how a household can make the same income as another household, however, their non-discretionary household expenses is what changes the difference in their total spending. Moreover, in the Diaz example, since Carlos and Gabriela earn a pre-tax income of $160,000 together as a household, they must find their optimal living standard for when they want to retire at age 67. I want to affirm that the Diaz family can allocate more their spending in order to achieve their best and sustainable living standard. However, each year may vary depending on certain expenses such as costly monthly car leases, meaning the optimal living standard may either call for a cut or increase in one’s actual spending depending on the year’s expenses.