Money should be uncomplicated. It is one objective of my writing Personal Finance Economics. It is a perilous journey to effectively put myself in another’s shoes when it comes to explaining personal finances. Experience and preference put everybody on a different starting line.

This semester, I am teaching undergraduates about life-cycle economics twice a week. Some of the fruit falls here. My students have just begun learning about investments because allocating savings to financial assets is important work. Next week begins stock investing, and I thought, “To set the stage, why not lead with you?”

We all want to be financially well and I cannot imagine that happening without our involvement with stock investing.

Here it goes.

Two Steps to Know

First step: don’t pay for investment advice. Weird charts, graphics, and Monday morning analysis are mind-numbing and provide no insight into the future. Academics have known this for years.

As

wrote this week,“80% to 90% of Active Investment Fund Managers are Underperforming….”

In stock-picking, that is. “Fine, you think. But what should I do?”

Second step: Avoid active investment management and save expenses. Substitute active advice with index funds. “Index funds?” A bit of street terminology is needed, and I will help with that. In the next few weeks, more steps are coming to extend your financial fitness. 💪

Investments are Relevant to Subscribers and Pretty Much Everybody

In February 2024, the Investment Company Institute reported, “more than seven in 10 US households had retirement plans through work or IRAs; being later in the life-cycle of saving, more than eight in 10 near-retiree households did.”

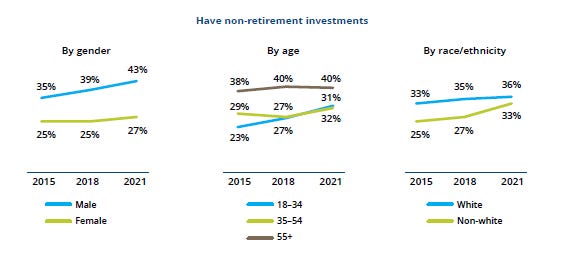

A decent percentage of the overall population, about 35%, have investments outside of retirement accounts. The latest report from the National Financial Capability Study’s follow-up investor survey illustrates the proportion of the population investing in non-retirement investments by gender, age, and race over the last three survey periods.

5 Minutes on Risk and Return

As you experience, household finances are subject to many risks, and investment risk is one of them. Do you wish you had bought a few shares of Nvidia five years ago?

FINRA, the U.S. organization that helps to oversee financial markets, has an educational foundation that constructed a risk-return game.

A good starting point to learn about investment risk and return is from the historical performance of investments. Historical performance informs future expectations about investment performance. Click through to the game and see if you learned something valuable. I bet you will.

This post simplified how risk and return work together and how investing is achievable for everyone, whether they are risk-averse or not. Explaining low-index funds made investing feel more doable and approachable for people newly entering the stock market. It pointed out that people don’t need investment management in order to be successful and that personal insight will go further than the charts shown on the news.

As someone who is personally somewhat risk-tolerant, I find this article incredibly insightful. While I may have made certain choices in the past, this article has the information I needed to stay on the right path. I also find this information very important for people to understand. Saving and investing early can set you on a path to success in the future. Understanding these accounts can also prove to make your future easier as you develop your knowledge.