3 Steps to Judging Where to Live

Day 18. Geographic choices, living standard effects, and well-being

Trevor Stoneman is like you, except he is not you. Hardly profound.

Trevor’s household is a prototype for thinking about where to live. The fun, the social, the zone of opportunity, and the wellness. A geographic choice isn’t just about the economics, but the right economics helps inform.

If you knew that living in Boston today is 56% higher than in Houston, and you had a job opportunity in each city, the cost of living difference might pause your decision-making. “Am I getting enough if I relo to Boston?”

How should you proceed?

Replace Boston and Houston with your choices. Then, three more steps.

3 Key Steps

Measure the cost of living differences for expenses you care about (I discuss below)

Consider income, benefits, and taxes (This is the easiest. You know your income and whether you have any employer-sponsored retirement plan like a 401(k))

Solve for the highest sustainable lifetime living standard in each location and weigh the best economic choice by non-economic preferences (I have a recipe for you)

How the steps apply to Trevor and you:

Trevor the Prototype

How can one not be a sports fan growing up in Bristol, CT? “Disruptor” is an overused term among business consultants and Shark Tank aspirants, but ESPN changed sports media, sports production, and the breadth of viewable sporting activity. Programming rotated from the early days of televised USTTA Table Tennis toward more popular entertainment and eventually ESPN’s acquisition by Disney. Sports programming is so economically consequential that ESPN offered contracts reportedly totaling $165 million for Buck and Aikman to work a night a week during the NFL season. Lucky are they who live in a country with fortunes created from the entrepreneurial spirit.

Trevor Stoneman was born in Bristol in the late 1990s. Every morning of his adolescence, he sat at the kitchen counter, catching up on the prior day’s sporting events while eating a breakfast of overnight oats and toast prepared by his mother. Ready for school, every day was game day for Trevor.

Trevor went to the SEC for a university education and became a sports management major. Graduating in 2017, Trevor parleyed his education into a full-time position at a Waffle House in Covington, GA. (nobody told Trevor to get into the business school), and he has kept his options open.

27-year-old Trevor is an analytical nut. Stat junky. Sneaks video clips of Stephen A’s latest segments and never misses “Fantasy Focus.” In his daydreams, friends call him “Boomer.” Most would judge his life as too narrow. Today, Trevor got lucky.

Job Offers in Different Locations

Trevor has two new pending job offers as an “event coordinator.” One job is located in Houston, and the other is in Boston. In terms of the professional entertainment job market and life, Trevor's decision is complicated. Salary is important, but so is proximity to pro sports and family. Financial well-being is in the mix, too. He never liked the Celtics or the Pats, preferred the Yankees, and loves the Cowboys. Trevor is close to his two sisters, who live in the Boston area, but he foresees a robust event and entertainment business in Houston.

The economics further complicates Trevor’s decision. He expects it will be cheaper to live in Houston than Boston. But is it?

Trevor’s step 1 is to assess how his expenses will differ between Houston and Boston. Below is the tabular view from Best Places for these two cities. Taxes are not considered in the Overall Cost value (it is a premium add-in), and the Miscellaneous category considers expenses such as restaurant spending, clothing, and entertainment. For this prototype, I added an Online/Location Irrelevant category for any budget items unaffected by location, e.g., streaming services, life insurance premiums, or existing amortized loan payments for student loans, auto loans, and so forth.

The cost of living in Boston isn’t even close to Houston. However, if he gets paid enough, that matters less and may be irrelevant.

Multiple Job Offers

Trevor’s Step 2 is the job offer details. Event Planning 101 in Boston has offered Trevor a first-year salary of $88,000 with a “401(k) matching” employee benefit retirement package. Event Planning 101 matches an employee up to 4% of annual salary, and Trevor intends to contribute 4% to maximize the match. The Houston firm Shade Tree Events, has offered Trevor a salary of $64,000 with a 401(k) plan that matches up to 2% of annual salary. Like the Event Planning 101 job, Trevor intends to maximize the 401(k)-match Shade Tree offers. Trevor expects future salary growth to match forecasted general inflation.

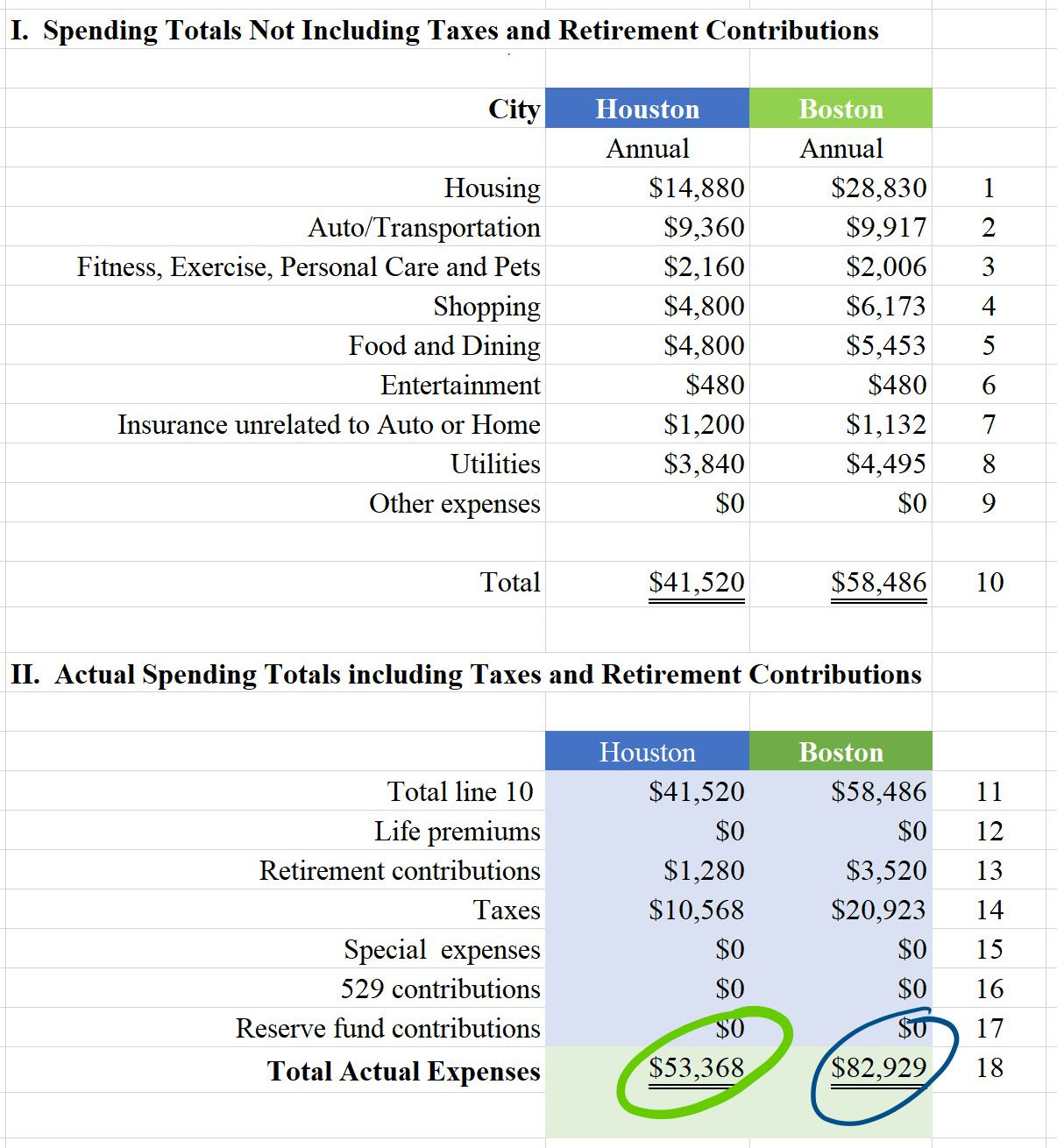

Geographic Effect on Actual Spending

The details of how Trevor foresees his budget in Houston and Boston are summarized below. Houston costs are treated as the base case, and Boston is adjusted with the Best Places adjustments. Given how Trevor prefers to spend his money, his annual spending, including taxes and retirement contributions (line 18 of Panel II), is 55% higher in Boston. Unadjusted for taxes and retirement spending, Trevor’s expenses are 41% higher in Boston, line 10 of Panel I.

Geographic Effect on Living Standard

The table above doesn’t include income and is a one-year “one-off.” We are ready for Step 3: Trevor’s highest sustainable living standard captures the big picture and includes estimated future income and taxes, Social Security retirement benefits, and longevity. I used MaxiFi Planner to run the life-cycle models.

Longevity for Trevor means an assumed max age of 95 and a preferred retirement just before age 70. Trevor is 27, so he is looking at 42 years of income production and 26 years of retirement, where the sources to pay his bills are Social Security retirement benefits and 401(k) withdrawals. Second, it is assumed Trevor would earn an annual nominal return on 401(k) plan assets, on average, 3.75% above expected long-term inflation. Along with future salary increases running parallel to inflation and the normal indexing of social security benefits for inflation, there are long-run inflation hedges built into Trevor’s best plan, regardless of city.

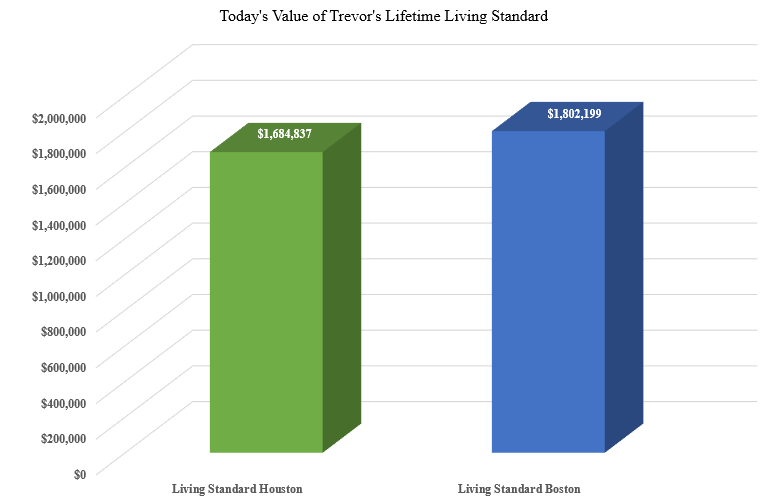

In economic terms, Trevor’s lifetime living standard is $1.684 million in Houston and $1.802 million in Boston.1

Why is Boston producing about $120,000 more of spending (in today’s dollars)?

On the margin, a higher-salary job produces,

Higher work earnings

Higher retirement contributions

Higher Social Security Retirement Benefits

Higher earnings on the 401(k) because account balances are higher

even though,

Housing expenses in Boston are higher

Federal income taxes and FICA taxes are higher

MA has state income taxes, while TX does not.

Is it enough extra spending to afford the higher costs of Boston beyond housing over the long run? That depends on the long-run cost differential of food, clothing, and spending for fun.

If Trevor is committed to the Boston area for non-financial reasons, then moving away from the metropolitan area to a suburb like Salem will incur new transportation expenses, but overall, he would have alternatives for basic living at a lower cost.2

Your Takeaway: It’s About the Methodology

Geographic choices are often presented to households. Job promotions, the advent of retirement, and the choice of step-down community post-retirement are common. The work-from-home alternative, which rose higher during the pandemic, has made this life choice relevant to more households. Cost-of-living estimators can inform the decision but alone are insufficient to resolve the question about the highest living standard.

The best geographic choice on strictly economic terms requires life-cycle modeling, too.

Your Next Steps

Are you thinking about relocation and how it will affect your living standard? Message me with your questions.

Course notes are attached, and Section 4.4 of the book and the case of Beth Banks provide another look.

To further adjust for locational differences, the living standard results were adjusted for an 8.25% sales tax rate in Houston and a 6.25% rate in Boston. If you are interested in Trevor’s complete financial plan, DM me or email me at robert@finplanllc.net, and I will send you a PDF of his results.

For the curious, Salem, MA’s housing is about 30% lower than Boston.

I had never really considered the idea of also comparing the cost of goods when deciding on a move. I knew that the largest contributing factors would be housing costs and income differences. However, the other costs of living were something I never though would have a notable deciding factor on moving or not.

This article was extremely helpful for me as I am nearing graduation in the Spring and narrowing down my job search based on location; this gave me a lot of things to consider. As much as I love Dallas, the jobs I’ve looked at in Arkansas pay more, and the cost of living is much lower. My living standard would also increase because some of my closest friends live there. This article made it apparent to me that beyond the financial benefits, listing out my priorities and picking the location that best supports them will drive my standard of living.