Every household has a living standard floor, but few can quantify it. Amid retirement and worry about the Dow dropping substantially, would it not be good to know your floor? The 45-year-old couple who have aspirations for their teenagers to go to college and have a comfortable retirement for themselves rely on good investment returns but know better returns come with risk, and a market downturn can define the line between living well and living poorly.

How do you feel about your living standard? Are you at ease because you know enough about your household’s financial condition to trust that you have done your best to minimize disruption risks?

The history of returns on financial assets suggests higher expected returns from stocks than bonds, T-bills, CDs, and bank savings if you accept their volatility. Diversification through stock index funds is essential but imperfect. Stock return risk cannot be eliminated by holding many different issues rather than a few.

Here is good news for the majority of the risk-averse population who like the idea of higher returns and a higher living standard for their households. “Upside Investing" is a technique in which your baseline living standard is never penetrated. Unlike today’s graphic, an elastic down arrow does not match Upside Investing’s concrete floor because the living standard floor is the annual budget number when investments are placed in TIPS - Treasury Inflationary Protected Securities. Upside Investing follows the rules of economics-based financial planning and closes out Chapter 6 of the book.

Today: The how-to of Upside Investing is presented with a case study for Jan and Roger Peterson, who have about ten years until retirement. We are not the Petersons, but their case gives teeth to the Upside Investing concept.

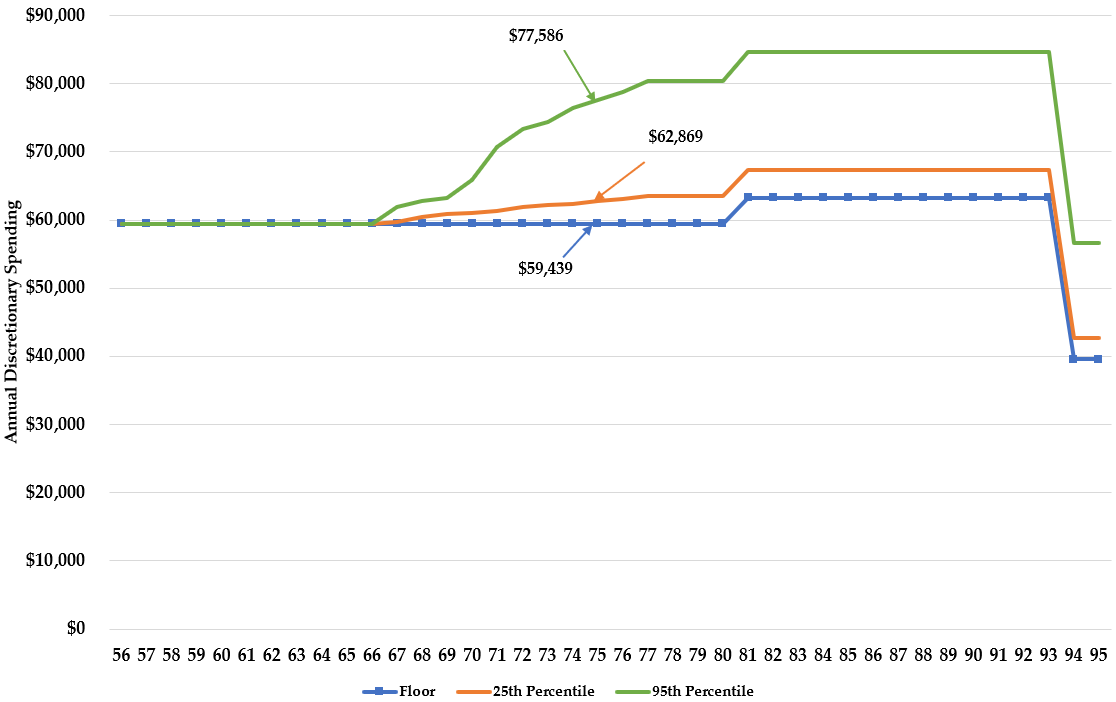

Two of the Peterson’s details are relevant. Roger has a defined benefit plan at work, where his employer makes the investment decisions. Jan, like most of us, manages an IRA. The floor, shown in the graphic below, is the Peterson’s annual spending cap in today’s dollars when Jan’s IRA drops to $0 because of stock market losses. The floor is important because the cap amount, in today’s dollars, is determined by household income, future Social Security retirement benefits, expected financial assets, taxes, and non-retirement assets invested in risk-free TIPS. Alternatively, if Jan invests in a Total Stock Index fund, the household cap will vary as defined by the orange and green percentile lines. At age 75, the Peterson floor is $59,439. If Jan’s IRA is in stocks, the 25th percentile cap is $62,689, meaning 25% of the simulated cap amounts were below $62,869 and 75% were above. Only 5% of the simulated cap amounts were above $77,586.

What do the Petersons do with this information? They talk and consider their household’s risk tolerance before deciding whether Jan should invest her IRA in stocks. If they do, and the stock market blows up, they have their floor.