Have savings? Where should it go?

Over the past two weeks, I wrote about the value of two financial accounts for household financial management.

A brokerage account with a cash management feature.

An account at Treasury Direct for easy access to I-Bonds and Treasury-Inflation Protected Securities for a low-risk investment to manage inflation risk.

Bank savings accounts exist, and they are generally low-risk, but do today’s advertised annual percentage yields excite anybody?

Want to streamline your financial accounts? Here is a prior post on the topic.

Moving Across the Risk Spectrum

“Investment risk and investment return,” the phrase we feel when thinking about how to put our money to work, appeals to our desire for more and our concern that money can be lost.

Households that save and need to make investment choices can have a little extra anxiety when thinking about stock market investing.

See if this helps.

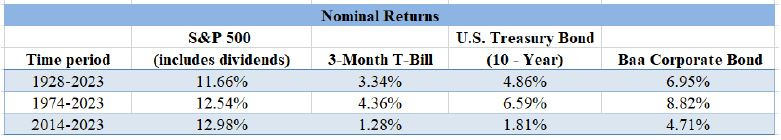

One way to think about the risk or volatility of a risky investment (any investment other than a T-Bill), is to look at the difference between the average returns on the investment v. the T-Bill. The table below comes from the work of NYU Prof. Aswath Damodaran who reported average annual returns on the S&P 500, T-Bills and two types of bonds over subsets of time periods covering nearly 100 years.

The annualized return over the longest time period shows, for example, that an investment in the S&P 500 portfolio earned an investor 11.66%, whereas an investment in Treasury bills would have earned 3.34%. That’s a premium for investing in stocks and taking the risk equal to about 8.32% (11.66% - 3.34%) annually. A Baa-rated corporate bond is less risky than a stock but more risky than a T-Bill, commanding a risk premium, on average, of 3.35% historically.

What Role Does Inflation Play in Returns?

We should care more about how returns are affected by inflation. These “real returns” include the effect of a change in our purchasing power.

Think of it this way: If you are saving money in a bank savings account that pays you 3.5% interest while inflation is 5% over the same time period, how would you feel about your savings? Not great. Purchasing power dropped. Worse off by saving.

Historically, what do we know about real investment performance?

The comfort of a very low-risk 3-Month T-Bill was lost between 2014 and 2023. Monday morning quarterbacking doesn’t help today’s decision-making.

Readers can infer that if inflation exists, salary raises and investment returns need to at least match inflation for the household living standard to not fall behind.

Stock investing and how to conduct basic research on individual companies whose stock may be of interest to you are included below in today’s class notes as part of the paid subscription.

Enjoy!