My God, they are happy. They even lost their glasses and adopted gender-binary shirts. They traveled down to Galveston Island for a weekend of Gulf oysters and a visit to Moody Gardens. They were relieved that walking is their exercise after seeing some road bikers battling the humid breeze while peddling south down Seawall Blvd. Retirement befits the Turners; however, work is to be done for the continued smiles, financial flexibility, and freedom to grow old in their comfort zone.

Who knows about the economy and tomorrow’s performance of investment assets? President Xi just consolidated power, and China is in disfavor today. Venezuela has partnered with Iran. Consumer spending in India post-Diwali is reported to be great among the wealthy; not great otherwise. In general, we are back to a geopolitical mess.

Financial markets are chaotic, while inflation eats household purchasing power. The “Great Retirement” describes generational behavior, not happiness. Sometimes, retirement is not that great. Details matter, and for many households, retirement appears unwise. Labor income is a more secure and predictable source of household cash than future investment returns. Reliance on work income helps manage the risk of equity investments. A household’s “portfolio” is more than financial assets, and better planning recognizes the importance of work and human capital. Throw in higher inflation, and households become more sensitive to this principle.

As readers know, I provided context through a newly retired middle-class couple in East Texas, Bubba and Helen Turner, who retired in 2021 but wished to contemplate a few more years of work. The Turner’s better choice was to re-employ Bubba for a few more years and defer Social Security retirement benefits. The Turner’s solution is very specific to their attainable living standard based on their available financial resources. Indexed Social Security retirement benefits were more important to the Turners because they supplied a higher percentage of their living standard. That is the principle of social adequacy in action.

To what extent did the Turner’s living standard solution depend on their 401(k) investment performance for the balance of their years? The initial assumption about future returns on remaining 401(k) balances was an unrealistic assumption: they would earn a 6% nominal return on their 401(k) balance. Near-term inflation would have a consequential impact. While a fixed, deterministic return on financial assets was applied equally to the “stay retired” and “return to work” scenarios, it is time to let prospective returns be variable.

Giving Texture to the Prospective Living Standard

The planning task is to inform the Turners better to help their decision-making today while comforting them about how bad their living standard could be. I must admit a bias toward utilizing a downside risk measure. When a household financial plan is built upon a living standard floor above which 95% of the time living standards will be higher, the information will be beneficial to risk-averse households. Most households are risk-averse and more so in the later years. So, here goes it.

The Turners have a 401(k) valued at $350,000 in today’s dollars. In front of them are two diversified investment choices that are well-known and easy to implement in practice:1

A “lower risk” investment where all the Turner’s financial assets, including the 401(k) are invested in a portfolio composed of 80% in the Total U.S. Bond Index and 20% in the Total U.S. Stock Index

A “higher risk” investment where the investment proportions are switched: 50% in the Total U.S. Stock Index and 50% in the Total U.S. Bond index

Commingle an investment choice with all the household attributes of the Turners, and an inflationary environment will yield new results.2 As a reminder, if Bubba goes back to work and the 401(k) earns a 6% fixed return, then the Turners achieved $237,000+ more discretionary spending over their lifetime due to:

$134,626 more in today’s value of Bubba’s work earnings four years

$134,952 more in today’s value of increased Social Security retirement benefits

$31,929 less in today’s value due to additional federal income tax and FICA taxes.

A More Focused Picture

The storyline takes a realistic approach. It simulates investment returns and puts odds on the Turners achieving their living standard under a) maintaining their retirement and b) getting Bubba back to work for four (4) more years while deferring their Social Security retirement start dates to age 67.

Bubba Stays Retired

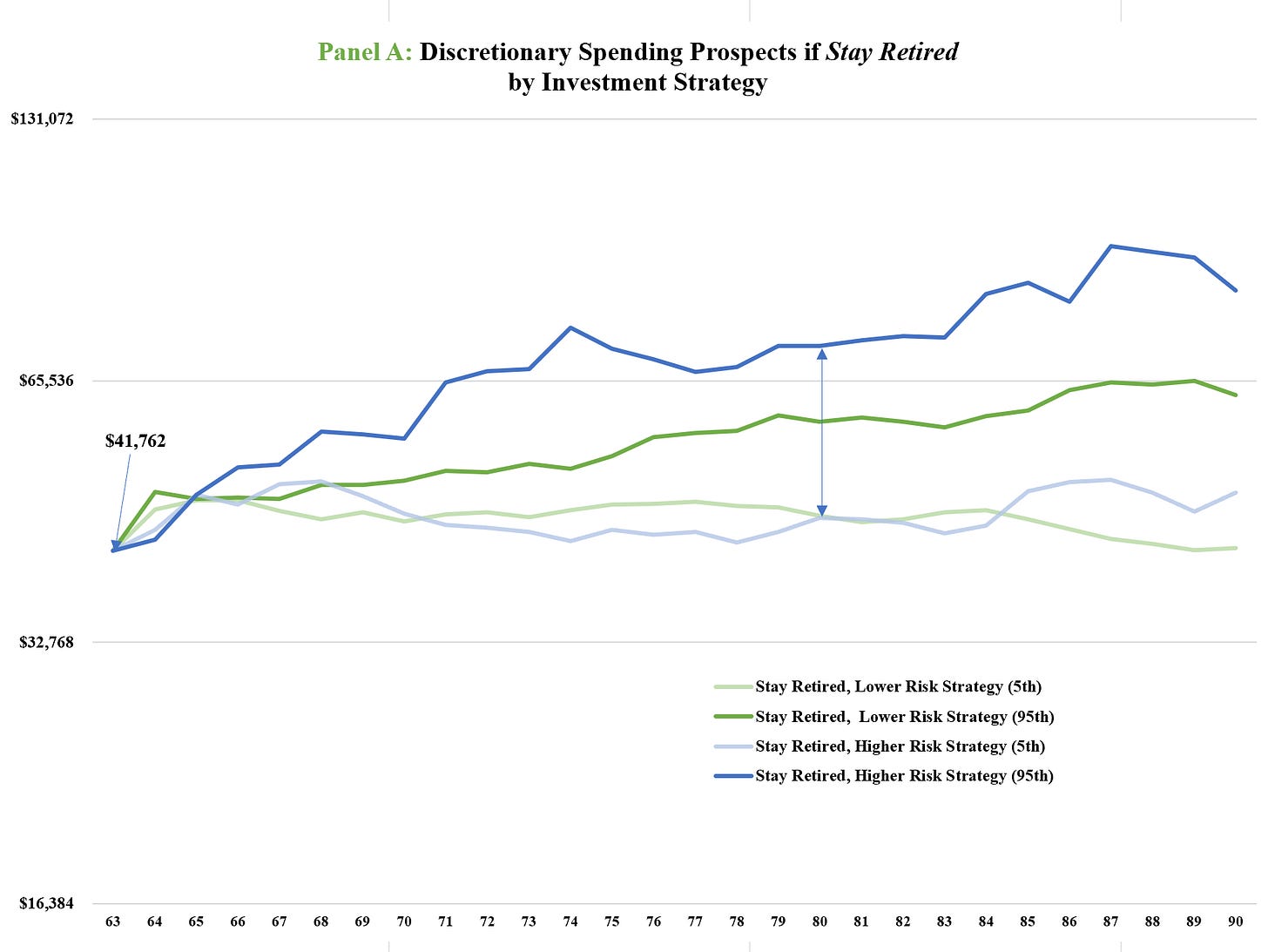

Panel A displays annual discretionary spending bands for the Turners from their first-year starting point level of optimal discretionary spending, $41,762. The lighter blue-toned line to the darker blue-toned line tracks the 5% to 95% percentiles, respectively, for discretionary spending when the Turners invest 50% in the total stock index. A narrower range results when only 20% is invested in the total stock index (the green-toned lines) with the balance in a bond fund.

If Bubba stays retired, at age 80, a lower-risk strategy offers a discretionary spending range between $45,816 and $58,805, while a higher-risk strategy offers a spending range between $45,551 and $71,384.

Bubba Returns to Work

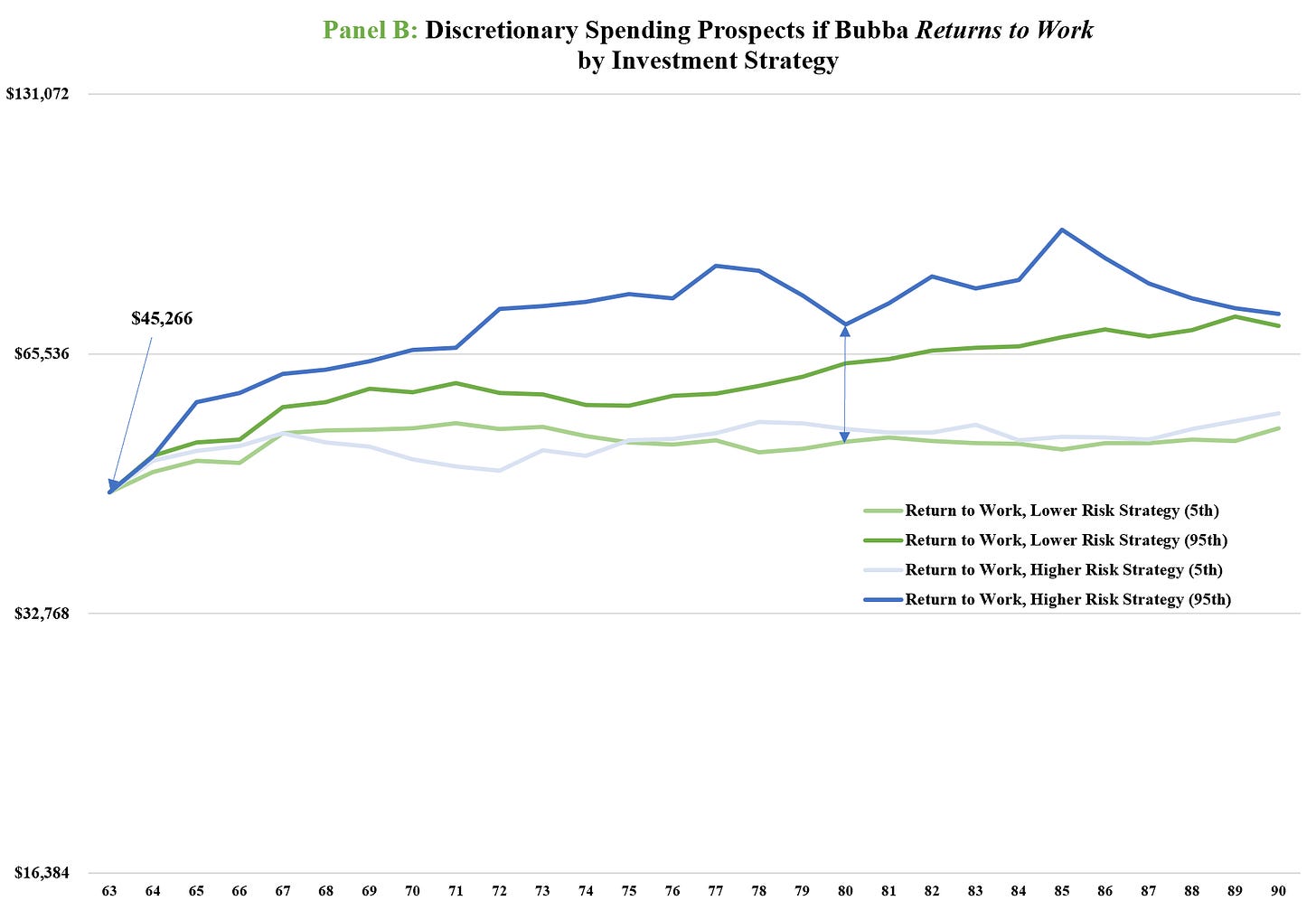

Panel B displays optimal discretionary spending under Bubba’s return to work scenario. In this case, discretionary spending today jumps about 8% to $45,266. Blue-toned and green-toned lines similarly differentiate the investment portfolios, with 5th and 95th percentiles taking their usual meaning. Choosing age 80 again to give some perspective:

If Bubba returns to work, at age 80, a lower-risk strategy offers a discretionary spending range between $51,882 and $63,382, while a higher-risk strategy offers a spending range between $53,681 and $70,952.

Higher living standards and a narrower range of living standards while confronting the same investment risk encourage Bubba to return to work if he is able and willing. Preferences for leisure matters and Bubba’s health and longevity prospects are important considerations in pulling the Social Security trigger. An unhealthy Bubba would shade the Turner’s decision toward an earlier start. A healthy Bubba makes an age 67 start date a better decision and enables a significantly higher living standard and more spending when at the beach. Remember, his return to work scenario is still only part-time!

Downside Risk

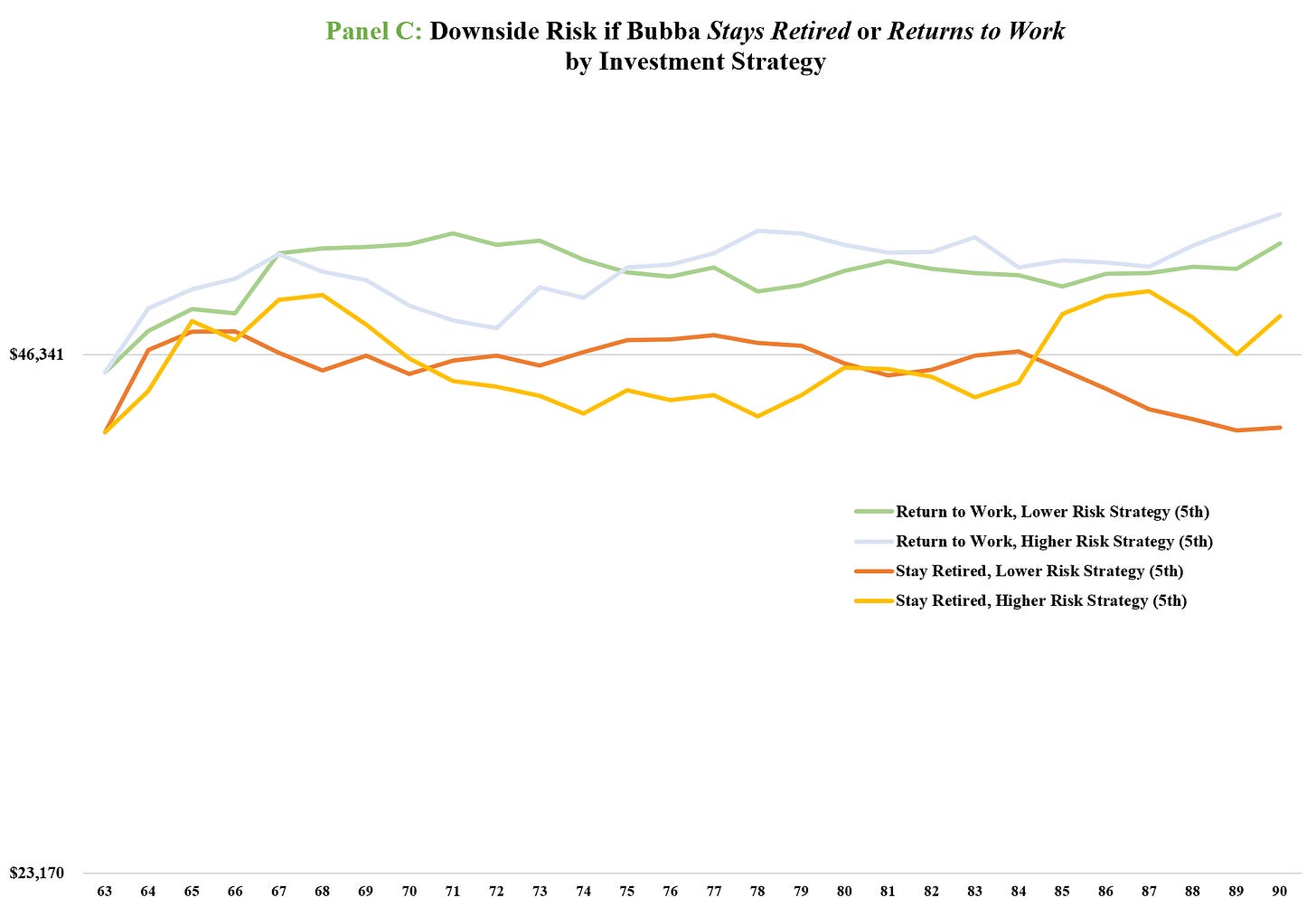

Panel C focuses on the 5th percentile outcomes for the work and risk scenarios wrapped up and packaged into a single image. No new data, just a different display. The vertical axis remains the annual level of household discretionary spending in today’s dollars. Return to work worst case scenarios are the blue and green lines. But look at those orange and red lines! They lie below. Return to work is the better choice. The Turner’s mix of stocks and bonds is their choice.

In any event, a pessimist about financial markets would find Personal Finance Economics’ primary recommendation for the Turners very comforting.

Bubba working a few more years and deferring the receipt of Social Security retirement benefits narrows the effect of the variability on the Turner’s standard of living due to investment risk because Bubba’s labor income and SS benefits are of more importance relative to the stay retired scenario.

Implication: Investment strategy and risk doesn’t much matter to the Turner’s stay retired decision.

That is good information provided by economics-based financial planning.

Example ETFs are Vanguard’s BND and VTI funds. Prospective returns are modeled from data built into

’s MaxiFi.Readers can find all the other financial planning details and household attributes in the prior post. If you would like a PDF version of Turner’s full financial plan when considering investment risk, send me an email at rpuelz@smu.edu.