Unlock Smarter Money

What is your approach when you have a financial question?

Search? Ask a neighbor. Just let it go because thoughts about money are too stressful.

Last week, I asked subscribers to participate in a one-question poll to help me understand whether direct messaging with me would be valuable as part of a paid subscription. It was simple, really. Yes or No? The results were slightly in favor of Yes. Many people wrote why they selected Yes or No, and I read every response.

It takes some guts to reveal what we know and experience, and what we don’t know.

A shared interest in personal finance binds subscribers, and I am relatively certain the population of subscribers is like my SMU students—some with expert-level knowledge and talent and most ready to learn something new about finance.

Still, and I repeat, “It takes some guts to reveal what we don’t know.”

Answering a subscriber's question about whether to begin withdrawing Social Security retirement benefits early is no different from answering another’s question about whether to lease their next car or how to increase their credit score.

Your question and your concern are there for a reason. I might be able to help. Another opinion, a guide for how to separate good financial advice from bad financial advice, a small addition of financial education.

Unlock smarter money

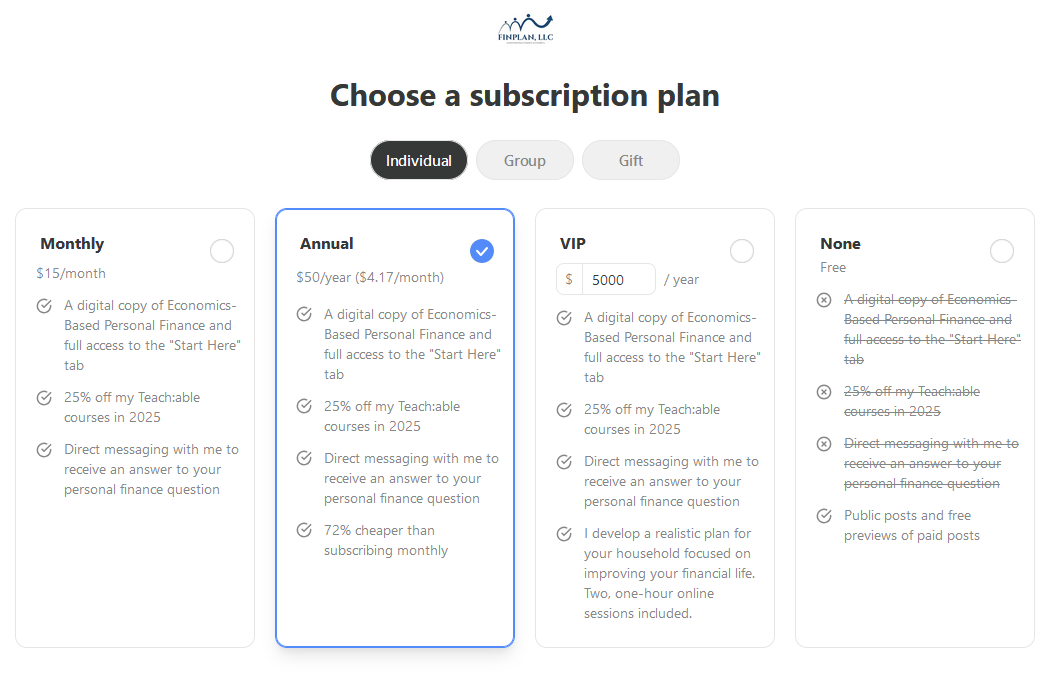

Given the survey results, here is my value proposition you can lock-in today for $50 for the next year:

The “Start Here” tab contains a series of essays and notes for individuals for whom personal finance is relatively new. It is a short course, along with the book.

A digital copy of Economics-Based Personal Finance.

25% off my video-driven short courses at my Teach:able school (content is coming by the end of January.

Direct messaging (DM) with me to answer your personal finance questions.

Annual paid subscriptions go to $99 in four (4) days.

Let the survey comments inform your decision.

I chose 9 “Yes” and 9 “No” responses, which are detailed below. They are edited slightly and anonymous. My thoughts are listed below each one, noted by “RP.” I even added a video about how to DM on Substack.

Yes, direct messaging would be valuable to me because

“I have been on the edge of subscribing (was holding for the new year because of other commitments), and this is part of what I consider extremely valuable. There are times when there is a question that isn't answered or that is pertinent for my situation, and to be able to get that answer is very, very valuable.”

RP: I am ready for you. If you hit the subscribe now button, you will be taken to a screen that looks like this:

Let's give it a try. I am not loving getting articles delivered to my email account. But I am curious about your work - so lets try it out

RP: I understand. If you are curious about PFE, you do not have to read the emails. You can get the same content through the Substack App or the Desktop site.

It would be awesome to be able to bring a financial question / problem to you for discussion, ideas, brainstorming, kitchen cabinet...even if such topics were to become anonymized topics for your posts / Stack.

RP: You can bring them to me directly.

“Just because I am lazy and it's faster / easier, at least sometimes, than combing through the archives. Possible that ChatGPT fixes this? Also, you've done a nice job cultivating the vibe of a "teacher" for this Substack so it somehow seems "right" to ask you things…”

RP: ChatGPT can be helpful, and I like Perplexity Pro much more than a Google search. I bring education, training, and experience to the mix, and it would be amazing if you value what I have to offer. Being “in” on personal finance knowledge helps absorb the content.

“It depends a lot on the cost. My husband and I are retired and have had a hard time finding someone to give us advice regarding our finances. We are not interested in having someone who wants to manage our investments, etc., but someone who can look at our overall finances and give us advice concerning investments, savings options, insurance options (like long term care), etc. Everyone we've found wants to take over all our investments which we are not interested in doing.”

RP: Yes, having your “assets under management” is how advisors make money for their time. There are fee-for-service advisors you might consider, and I can offer a path to find them. In addition, as a paid subscriber, you always have me as a backstop.

“It is always good to have a 2nd set of eyes on any financial issue to reveal facets of the issue you may have overlooked.”

RP: My role as a “2nd set of eyes” is one of my primary value propositions for paid subscribers.

“My situation is not the average persons situation so if I were to pay for a subscription it would require the ability to get my specific questions answered or else it would not provide enough benefit to me.”

RP: That makes perfect sense to me. The approach to PFE is to offer essays about every day and substantial personal finance decisions. Paid subscribers can comment and ask questions, which is often a good way to do it. In addition, I will be launching more granular courses on Teach:able as I learn more about what my subscribers value. That may include 1:1 coaching sessions.

“I have lots of questions about retirement!”

RP: Then you may love to have DM capability! Paids also receive the book and the method to evaluate many retirement questions. Two relevant ones are whether to take IRA, 401(k), or 403(b) money and convert it to a Roth. A second is when to begin withdrawing Social Security retirement benefits.

“I am …in early retirement and doing things on my own using MaxiFi Planner… I still have questions and being able to DM you would be great though I am really not sure how to do that. Do I reply to one of your emails?”

RP: Check out this how-to video to DM me.

If you would like alternative approaches to DM, here is what Substack writes.

2. No, direct messaging would not be valuable to me because,

“I'm fairly well versed with a MS in Finance. I've been managing my own money for almost 60 years. I was well taught by my parents.”

RP: That is terrific. You may have broader questions, such as about Roth conversions or when to withdraw your Social Security retirement benefits. Let me know if I can help.

“I'd like to get to know your writing style and material before I would commit to a paid subscription. That is how I've approached each Substack subscription.”

RP: That makes perfect sense to me. You will find the content is based on the state of our knowledge, and I strive to explain topics as cases. I hope you see value in it.

“No, if it would lead to a higher subscription price and, personally and, personally, i'm on a beginner level...much too early to navigate complex topics with an advisor....at least, not yet...but great question.”

RP: There is no higher subscription price for direct messaging with me. It is a feature of a regular, paid subscription. By the way, most of my university students came into my class without any prior experience. I have your back.

“I have financial managers.”

RP: I assume they are offering investment opinions. My approach is broader because identifying your highest living standard has many inputs, prospective investments is one of those. Send your managers to subscribe. I know they would learn something, and that would help you.

“Don't think I'm concerned with same problem as most of your subscribers.”

RP: I am intrigued. If you want to elaborate privately, drop me a note at robert@finplanllc.net.

“My concern is how to help daughter preserve a large inheritance and invest to more than beat inflation. She'll never be much of an investor, too impatient and impulsive, so mostly needs to learn how work knowledgeably with an adviser. Has an illness that will keep her from working, so mistakes could easily be catastrophic. Not sure how you can help with that.”

RP: First thought…..Assume a trust to help manage her money is a part of your current plan. If not, that would be my first stop. At some point in her life, she will lose your guidance. In the near term, I can field your daughter’s questions about working with an advisor, including how to choose one. She definitely needs the right one.

“I'm not in such a rush to get information. I'm just in for the entertainment”

RP: Entertainment, indeed! I hope you find every post a good read. When you have questions, you know where to find me.

“I do not know you, even via Subtack, and so do not trust a direct messaging set up.”

RP: I feel that way with an online platform. In turn, I have tried to be transparent about who I am. Hopefully, my bio is clear, and my intent of bringing Personal Finance Economics from my classroom to a larger audience gives you comfort.

“I am fine with a general or public Q&A option.”

RP: Commenting on public posts is always a choice. I try hard to respond to each comment.

Thank you ‘all for being subscribers to Personal Finance Economics!