Jenny Burke is in her late 20s, now in her responsible singleness, earning an investment banker’s wage with her social media skills. Like nearly everybody, she has an unpredictable income, and every time she spends a lot of money on herself, her stomach gets a little more acidic. She keeps a Costco-sized bottle of Tums at home.

Jenny is trying a different script, thinking that tracking spending explicitly might ease the symptoms: less obsession, less gut wrench after exhilarating spending self-care.

Jenny values knowing, but that is Jenny. We would need to peel the onion back a couple of layers to understand her motivation completely.

For the Jennys (I am one, BTW), there are a zillion budget apps from Monarch and YNAB to upstart Fina money. Frankly, they are powerful tools and can make spending tracking time efficient for the user because the user sets up the app by listing all their financial accounts, which permits the software to scrape the accounts for transactions periodically.

The product is best-case financial information. Most households have multiple account types: checking, savings, brokerage, and maybe multiple credit cards. The budgeting apps grab user data from multiple sources, and numerous transactions, and the user gets a roll-up of their expenses by category: income, groceries, utility bills, insurance, etc. Visualization and time-efficient for the Jennys of the world.

Apps begin to separate themselves from the competition by the reliability of the scrape and the quality of the built-in visualization tools.

If a budget app doesn’t guarantee it can communicate with every one of your financial relationships, don’t buy into it.

They will offer the ability to enter transactions manually to provide them with cover, but that is too 20th century, and the charm soon wears off for the user. Manual user input is okay for a one-off transaction. It doesn’t work for a financial relationship with many transactions.

Budget apps can be improved by integrating forward-looking economics-based planning principles with historical spending patterns. For this reason, I’ve explored a Personal Finance Economics app for my paid subscribers that fills in existing products' technological and intellectual gaps.

This had me wondering whether there are enough Jennys. In general, are households excited about budget apps and technology?

“Survey Says”

Every few years, the FINRA Foundation collects data about the financial capability of U.S. adults, “including financial knowledge, resources, access, experience, and attitudes.” This database is very useful to researchers interested in financial literacy, financial behaviors, and financial experiences and is a dataset I have used in published papers.

The survey developers structured a question that helps us understand the interest in tracking spending and the utility of budgeting technology.

Specifically, respondents were asked this question:

“How often do you use websites or apps to help with financial tasks such as budgeting, saving, or credit management (e.g., GoodBudget, Mint, Credit Karma, etc.)? Please do not include websites or apps for making payments or money transfers.”

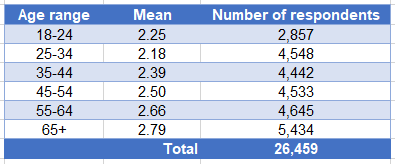

What are the respondents’ choices beyond “don’t know?” A straightforward “frequently,” “sometimes,” or “never” scored as a 1, 2, and 3, respectively. If the stats show an average value of 1, every respondent chose frequently. Of course, chosen values will be distributed across a sample of individuals.

What the Data Show about Financial App Usage

The evidence points to not much.

The table below was created with choices from more than 26,000 respondents across age ranges. Within an age range, the mean value falls somewhere between sometimes and never and pretty much never for those over age 65. These data were released in 2022 and are slightly dated. They show no overwhelming interest in budget apps and technology regardless of age range.

Education level makes no difference,

What is going on? The “Nevers” could be very interested in their financial matters but hand them off to a spouse, financial advisor, or tax accountant. This would be consistent with our 2022 research finding of no support for a causal relationship between financial literacy and economic outcomes. This may be because high-income, high-productivity people are more likely than not to offload financial knowledge to financial experts. Others who answer “Nevers” may have little interest in a budgeting app or don’t have the time.

What can we make of the lack of interest in budgeting apps? Are many people missing the opportunity to better their financial lives? I think so, but not for the reason the budgeting app developers push.

Budgeting apps are sold as a method of financial control

However, how we spend is discretionary, and in our control, and budget apps have simple substitutes. The “Female Finance” writer

shared with me that she prefers to build her spreadsheet for spending and use autopay to ensure her predictable bills are paid. On the one hand, that makes sense to me because a manual approach is engaging, and spending awareness can be heightened when every transaction is diligently recorded. On the other, if you have more than an account or two, it simply becomes painful, and the pre-built budget app world has very nice visualization tools that save a lot of macro coding.Whether you use a budget app, spreadsheet, or nothing, I have a hypothesis to test:

I attribute less than wholehearted interest in a budgeting app to the disdain many people would have with the little app man on their shoulder 🙈 while they navigate their week.

Budgeting Apps Do Offer More

Unless you reside in a cave, you will have financial transactions daily, and the number can quickly reach double figures. If you are an obsessive, the little app man can save you a bunch of time. If you dislike having the little app man on your shoulder, log in occasionally. You might catch a fraudulent credit card transaction or two or a mistaken non-fraudulent amount charged by a vendor that was an honest mistake that happened to be in their favor.

A simple fact remains: your financial transaction paper trail exists.

You may find mistakes when you look at the information on your terms neatly organized into a budgeting app package. But, you may also learn you are spending and saving in a fashion that forecasts a healthy retirement or a well-funded college education.

Jenny may be just a fastidious personality type or easily stressed by financial anxiety who uses a push-the-button financial app to relieve herself.

The app used as self-care.

A wellness move.

Brillant.

That “little app man on your shoulder” analogy was spot on. That’s exactly why some people avoid budget apps, they don’t want a digital nag reminding them of every latte purchase. But the reality is, financial literacy doesn’t always lead to better financial outcomes (as your research points out). High earners often outsource the hassle, while others just prefer a hands-off approach.

I really enjoyed reading this and am surprised to learn about the underwhelming interest in budgeting apps! Building the Accountable budgeting app with my husband completely transformed our approach to budgeting and financial wellness. We set out to build an app that makes shared budgeting easy for couples, families, and groups. We wanted users to be able to personalize their budgets, set their own categories, and sort their own transactions. By using and testing the app I learned that it takes time to nail down a budget and understand your spending habits. After using Accountable for a full year I was able to see clearly where our money was going and felt empowered to make positive changes. I wonder if people don't stick with budgeting software for long enough for it to make an impact?

I would love to hear more about your vision for a personal finance economics app!