How to Find Financial Advice

Your path to clarity

The obvious: most of us prefer lower interest rates. The housing market will remain tepid until mortgage rates soften further.

Today, there are subscribers with other consequential financial decisions.

Some subscribers have financial advisors who are really investment advisors. Frankly, paying a financial advisor 1-2% of your assets each year seems ridiculous in light of the evidence that financial advisors just cannot regularly beat a simpler approach.

Others use money writers, the “FINCON” crowd, who have built an online presence through online entertainment. Funny, approachable, and clever purveyors of financial gobbily-gook that serve the bottom 90%; “money creators” reach households that don’t get the attention of the private wealth management crowd.

That might be a good thing.

And, it might not.

Quality is Highly Variable

How do you decide who to share your personal finance journey with?

There is a lot of water between an online money writer and a financial advisor with an absurd number of credentials. A couple of years ago, I wrote about Monte Jackson. The read is relevant today.

Talent is iffy.

Most care about selling financial products.

Most are fun to be around.

Demand for Guidance is High

Many financial products will not fit you. A single stock. A whole life insurance policy. Another high APR credit card.

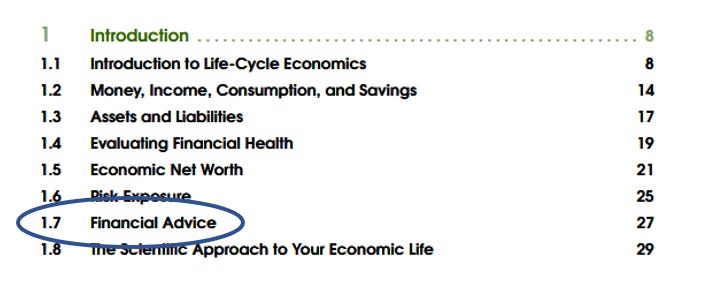

All this has me thinking about financial advice. I dedicate a section of chapter 1 to the topic, and the first chapter of the 2026 Economics-Based Personal Finance will be released to paid subscribers later this week.

Your Sneak Peek

Here is your three-stage checklist when you are seeking financial advice or testing if the cost of your adviser is worth it,

Plain speaking with a client means making the language of finance clear; the terms, definitions, and the role of financial institutions are easy to understand. The planner should know legacy and modern investment vehicles, the value of diversification that extends beyond financial assets to human capital, and asset allocation.

The planner knows how to consider and implement household attributes and apply an economic decision metric to make decisions. In other words, the planner can calculate the highest sustainable living standard attainable to identify the best financial planning path.

The planner has enough background in tax and estate planning law to point a client toward other providers with expertise in these areas, if needed.

Have a great week!