Short note.

I subscribe to the Insurance Information Institute’s daily blog and wanted to share a preliminary estimate of the fire damage in LA County.

J.P. Morgan and Morningstar estimate $20 billion in insured losses. This isn’t economic loss; it is only losses incurred that are insured.

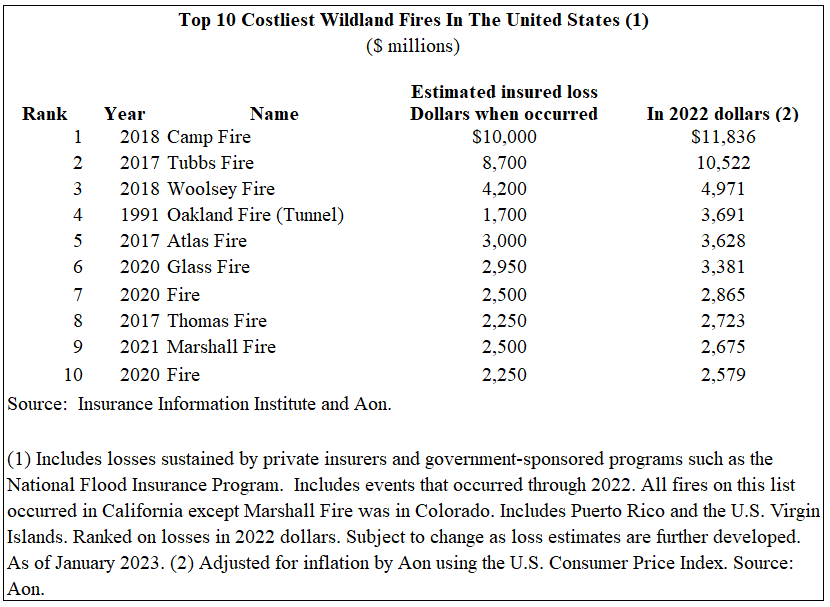

Here is a list of California's top 10 most costly fire losses, with the Tubbs fire coming in a far second to the current estimates in LA.

Why The CA Losses Matter

Two reasons. Insurers live in a global market, and their balance sheet constrains them from offering unlimited insurance at favorable prices wherever and whenever they want. Throw in a dose of unexpected inflation that drives higher the costs of items required to repair or replace damaged property, and you get an insurance market ripe for failure.

That can mean the insurance required to borrow the money to buy a home is impossible. If you own a home, good luck selling it to any non-cash buyer.

Beyond the wildfires, California has an insurance market mess, and the only good news from this disaster is that reform must follow.

Interesting take.

Most people don’t understand how actuarial science works. I fear there will be rippling ramifications across the country between the FL and NC storms and now the CA fires.