My students are building basic financial skills this week and sharing one discussion point with you.

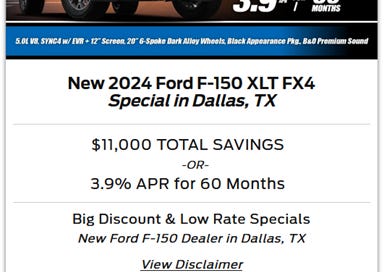

The image above is typical of a car ad in the U.S. when supply is higher than demand. You don’t have to love trucks to learn the financial principle on display.

The sales pitch in this ad is enticing: $11,000 in total savings or financing at 3.9% for 60 months. It reads like a screaming deal. However, the keyword is “or,” and by the way, there are no advertising words about price. (I found a price estimate lurking in the disclaimer.)

The price after the $11,000 in promotional savings is $59,575. If you want the financing, the price is different, $68,575. “Or” matters.

Both prices are before tax, title, and licensing, and sales taxes on trucks and cars in Texas are 6.25%; a financial detail inconsequential to the principle.

Why is there a difference in price when financing is at 3.9%? Additional financing charges.

The truck, its form, smell, utility, and market value are tied to a price of $59,575. Beyond that, the convenience of paying for the truck over five years has its own price because of financing charges much more than a 3.9% APR. By my estimates, it is nearly 9.8%.

The way to get a below market rate of 3.9% financing for 60 months? Tell the sales team, “I want the and.” “$11,000 in total savings and 3.9% financing for 60 months.”

Who knows? You may get the deal and the interest rate as promised.

This post emphasizes the importance of scrutinizing promotional deals for hidden costs. Asking for both savings and the lower financing rate may be worth a try, though it’s typically not offered upfront. This lesson teaches students to critically evaluate financial offers and understand how financing affects the true cost of a purchase.

The focus on the "or" in the promotion and the breakdown of the actual costs after financing charges is an eye-opening reminder to dig deeper into the fine print before making financial decisions.