5 Minutes To Learn About Risk and Return

This quick game will help you make better investment decisions

Personal Finance Economics is about learning something new and having an assisting resource for your personal finance questions. Today’s topic is a quick start on investment risk and returns through a short, interactive game constructed by FINRA’s education foundation. What is FINRA? It is an organization that helps oversee financial markets.

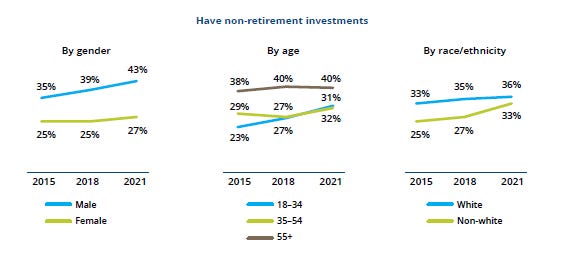

I don’t have to guess investments are relevant to subscribers or pretty much everybody. In February 2024, the Investment Company Institute reported, “more than seven in 10 US households had retirement plans through work or IRAs; being later in the life-cycle of saving, more than eight in 10 near-retiree households did.” A decent percentage of the overall population, about 35%, has investments outside of retirement accounts. The latest report from the National Financial Capability Study’s follow-up investor survey illustrates the proportion of the population investing in non-retirement investments by gender, age, and race over the last three survey periods.

A basic working knowledge of investments will enhance your financial literacy and, heck, might surprise your friends.

5 Minutes to Test and Learn

The exercise is about investment risk and investment return. Household finances are subject to many risks, and we isolate investment risk in this post. Risk is uncertainty, and the outcomes (the returns) can be good or bad. Typically, we begin to understand investment risk and return from the historical performance of investments, which informs future expectations about investment performance. Click through to the game and see if you learned something valuable. I bet you will.

Interesting to think about how every person has a different risk tolerance and how it depends on many personal finance factors and age. Older individuals are more risk averse, while younger individuals are probably more risk tolerant.

Do you mean the job choice is risky?